Understand what is competitive intelligence and how it works. This guide breaks down the CI process, tools, and strategies you need to outsmart the competition.

At its core, competitive intelligence (CI) is all about ethically gathering and analyzing information about your market, your industry, and—of course—your competitors. Think of it less as a rearview mirror focused on what's already happened, and more like a high-tech GPS mapping out the road ahead, showing you the opportunities and potential roadblocks before you get to them.

Understanding Competitive Intelligence In A Modern Market

True competitive intelligence goes way beyond a casual glance at a rival's website. It's a systematic, ongoing process: collecting raw data, connecting the dots through analysis, and then using those insights to make sharp, well-informed business decisions.

The best analogy is a chess grandmaster. A novice just reacts to their opponent's last move. A grandmaster, on the other hand, is thinking three, four, even five moves ahead, setting up a win long before the final pieces are captured. That's what a good CI program does for your business.

This proactive approach is what separates companies that lead the market from those constantly struggling to keep up. For a great deep dive into the practical side of this, 100Signals has published A No-BS Guide to Competitive Intelligence for Software Agencies that really gets to the heart of it.

Why CI Is No Longer Optional

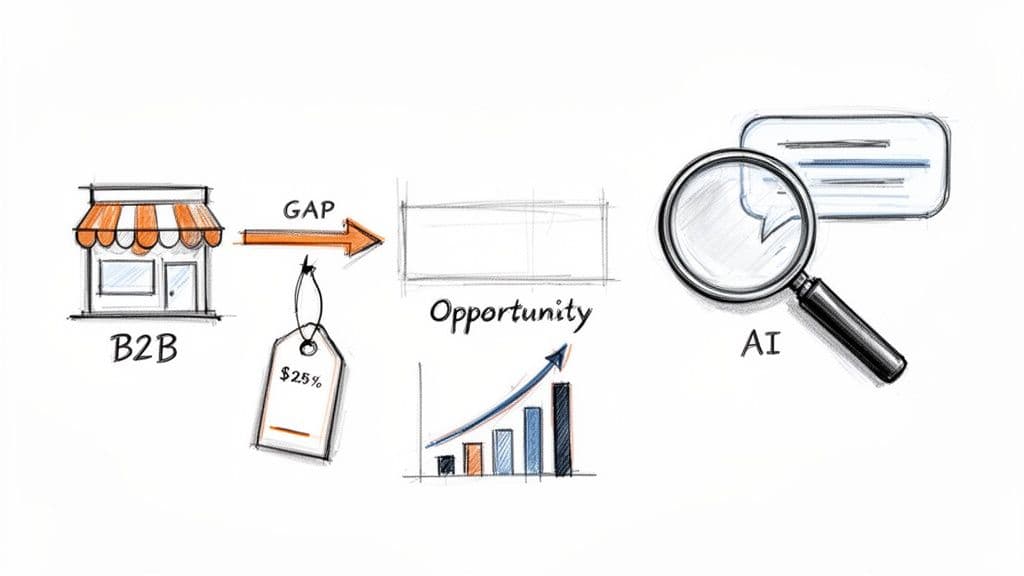

What was once a niche activity for large corporations has become a fundamental part of modern business strategy. The global competitive intelligence industry was valued at an estimated 8.2 billion in 2023** and is on track to more than double to **16.8 billion by 2030. That explosive growth says it all—CI is now a must-have for B2B companies trying to navigate crowded markets.

A solid CI framework allows a business to:

- Anticipate Competitor Moves: Are they suddenly hiring a dozen new sales reps in a specific region? Did their CEO mention a new product focus at a recent conference? These are the clues that help you predict their next big play.

- Identify Market Gaps: By pinpointing where your competitors are falling short, you can discover valuable, untapped opportunities for your own products and services.

- Sharpen Your Own Strategy: These insights should directly inform everything from your pricing models and product roadmap to your marketing campaigns and sales pitches.

- Mitigate Risks: CI acts as an early warning system, flagging potential market shifts or competitive threats long before they turn into full-blown problems.

The New Frontier: AI-Driven Search

The game has changed again. A critical new layer of competitive intelligence involves monitoring how your brand and products show up in AI-generated answers from tools like Perplexity and ChatGPT. This is where you can track brand mentions online within these new AI-powered ecosystems to see what's being said.

Competitive intelligence is no longer just about tracking competitor websites. It’s about understanding how the entire information ecosystem, including AI models, perceives and presents your brand versus others.

This isn't just a "nice to have" anymore. With more and more customers turning to AI for answers, ensuring your brand is visible, accurately represented, and favorably compared is absolutely essential.

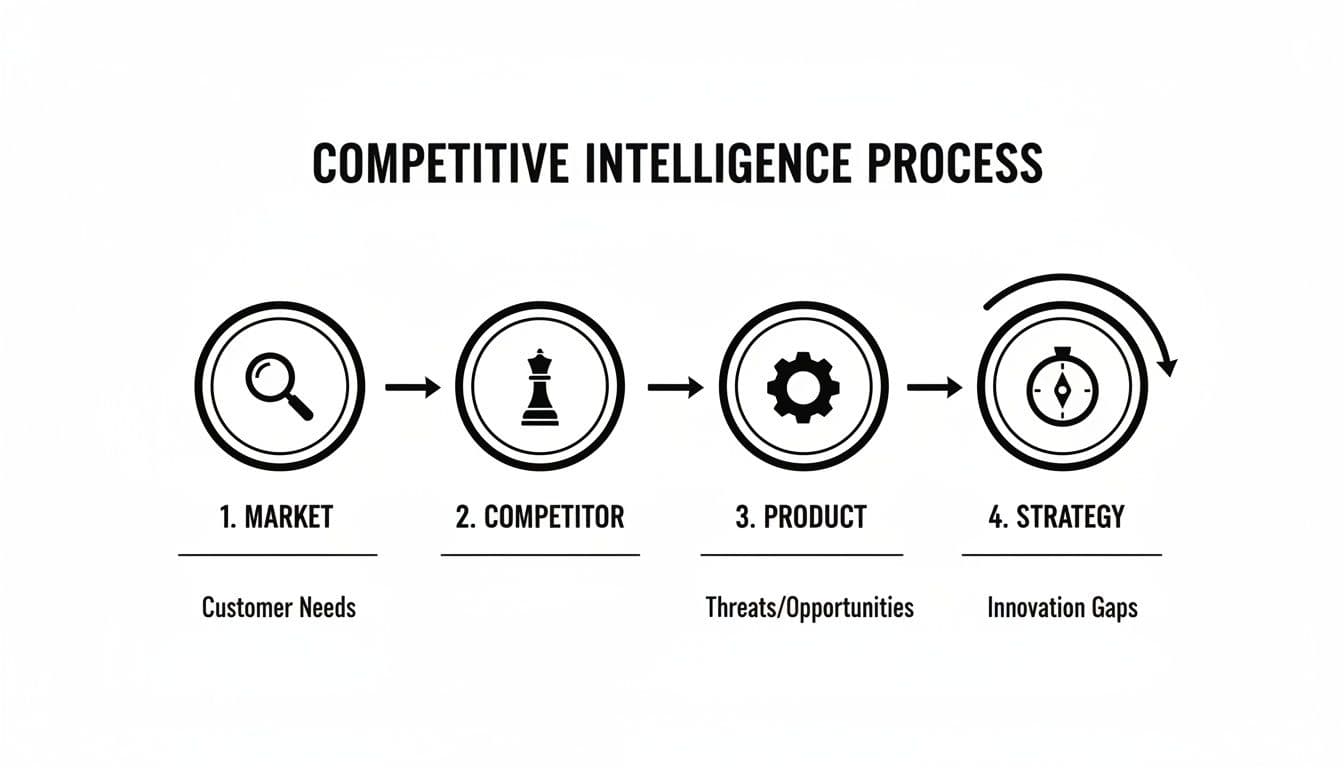

The Four Pillars of an Effective CI Program

Competitive intelligence isn't a single activity; it's a complete system built on four distinct, yet interconnected, pillars. Each one gives you a different way to look at your market. When you bring them all together, you get a full, three-dimensional picture of your business environment. Getting this framework right is the first step toward building a CI program that actually delivers strategic value.

Think of it like building a house. You wouldn’t just throw up walls and a roof. You need a solid foundation, a sturdy frame, reliable plumbing, and safe wiring. Each piece is essential, and if one fails, the whole structure is at risk. A great CI program is no different—it needs to be strong across all four pillars.

Pillar 1: Market Intelligence

The first pillar, Market Intelligence, is your wide-angle lens. It’s all about understanding the macro forces shaping your industry—the big, sweeping changes that affect everyone. This isn't about what one competitor is doing, but about the entire ecosystem you operate in.

Market intelligence helps you answer the big-picture questions:

- What major industry trends are just over the horizon?

- Are there any regulatory changes coming that could upend our business model?

- How are our customers' broader expectations and behaviors shifting?

- What new technology could disrupt the entire market?

For example, a B2B SaaS company might use market intelligence to track the growing demand for AI-powered automation. This isn't just a signal to add a new feature. It's an insight into a fundamental shift in customer needs that will define the next wave of market leaders. Ignoring these high-level shifts is like sailing without checking the weather—you might be fine for now, but you could be sailing straight into a storm.

Pillar 2: Competitor Intelligence

While market intelligence looks at the whole landscape, Competitor Intelligence zooms in on the individual players. This is the classic part of CI, where you systematically track the specific actions, strengths, and weaknesses of your rivals, both direct and indirect.

This pillar is all about building a detailed profile for each key competitor. The idea is to move past surface-level observations and truly understand their strategy, their capabilities, and what they’re likely to do next. You're searching for patterns in their behavior that reveal their real intentions.

A great competitor intelligence program lets you anticipate your rival’s next move, not just react to their last one. It shifts your strategy from defensive to proactive.

By keeping a close watch on their hiring trends, pricing changes, and marketing campaigns, you can start to build a predictive model of their behavior. That's how you stay one step ahead.

Pillar 3: Product Intelligence

Next up is Product Intelligence, which narrows the focus to a granular level. Here, you’re analyzing the actual products and services your competitors offer. It’s an objective, feature-by-feature breakdown of their offerings compared to your own.

This pillar means dissecting everything about a competitor's product:

- Feature Analysis: What new features did they just launch? How do they stack up against yours?

- Customer Reviews: What do their customers love or hate? Diving into reviews on sites like G2 or Capterra can uncover critical weaknesses.

- Development Roadmaps: Can you find clues about what they're building next in their job postings or press releases?

- User Experience (UX): Is their product easier or harder to use than yours?

A solid product intelligence process gives your product and sales teams the hard data they need. It helps them answer crucial questions like, "Where are our biggest product gaps?" and "Which of our features gives us a real competitive edge?"

Pillar 4: Strategic Intelligence

Finally, Strategic Intelligence pulls everything together. This is where you connect the dots between market trends (Pillar 1), competitor actions (Pillar 2), and product details (Pillar 3) to shape your own long-term vision. It's the highest level of analysis, turning raw data into forward-looking guidance.

Combining these different data streams gives you a much more complete picture, which is essential for things like effective AI brand monitoring and making sure your message cuts through the noise.

This is the pillar that helps leadership make the big calls—market entry, mergers and acquisitions, and long-term resource allocation. It’s what helps you spot disruptive threats before they become real problems and uncover those "blue ocean" opportunities your competitors have completely missed. Ultimately, strategic intelligence is what elevates CI from a simple reporting function to a core driver of business growth.

How to Build Your Competitive Intelligence Process

Knowing what competitive intelligence is and actually doing it are two different things. To get from theory to action, you need a repeatable process. Think of a solid CI process as a well-oiled machine: it takes the raw material of scattered data and turns it into the finished product of actionable business strategy. It keeps your efforts focused, efficient, and consistently valuable.

This isn't a one-time project. It's a continuous cycle where each stage feeds directly into the next, ensuring your intelligence never gets stale and your strategy can adapt on the fly.

Stage 1: Planning and Direction

Before you even think about collecting data, you need to figure out what you need to know and why. This is the most crucial step because it ties your entire CI program directly to what the business actually cares about. Skip this, and you'll end up drowning in useless information—a classic case of "analysis paralysis."

The trick is to nail down your Key Intelligence Questions (KIQs). These are the high-priority questions that your leadership, sales, and product teams need answered.

Good KIQs are:

- Specific: Don't ask, "What are our competitors doing?" Instead, ask, "Which specific customer segments is Competitor X targeting with their new feature launch?"

- Actionable: The answer has to inform a real decision. "How is Competitor Y's pricing change affecting our Q2 sales pipeline?" is a question that forces you to think about what to do next.

- Time-Bound: Focusing on a specific timeframe, like a quarter or a product launch window, keeps the research sharp and relevant.

This targeted approach means you're spending resources on finding information that actually matters. It's the difference between aimless web surfing and a focused investigation.

Stage 2: Data Collection

Once your KIQs are set, it’s time to gather the intel. A good collection strategy pulls from a mix of sources to paint a complete picture. The key here is to operate ethically, focusing only on information that is publicly available.

You’ll be tapping into two main types of sources:

- Secondary Sources: This is all the stuff that’s already published. Think news articles, press releases, public financial reports, competitor websites, social media chatter, and customer review sites. These are great for spotting broad market trends and official company announcements.

- Primary Sources: This is new data you gather yourself. It could be insights your sales team picks up in customer conversations, feedback from your support channels, or even running your own surveys. Primary sources give you the rich context that secondary data often misses.

Using modern CI tools to automate the collection of secondary data is a huge time-saver. It frees up your team to focus on the much more valuable work of analysis.

Stage 3: Analysis and Synthesis

Raw data is just noise. The analysis stage is where you turn that noise into a clear signal. Here, you'll start connecting the dots, identifying patterns, and figuring out what it all means. This is where you actually answer the KIQs you defined back in stage one.

A simple but powerful framework for this is the classic SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis. Applying it to a competitor helps organize what you've found. For example, a competitor’s strength might be their killer brand recognition, while a weakness could be terrible customer reviews for their flagship product. An opportunity could be an underserved market they’re completely ignoring, and a threat might be their recent acquisition of a nimble, innovative startup.

As this shows, the CI process is a unified flow. Each step builds on the last, turning broad market awareness into sharp, focused strategy. For a closer look at the nuts and bolts of analysis, especially for digital marketing, check out our guide on how to do competitor analysis in SEO.

The goal of analysis isn't just to report what happened; it's to explain why it happened and predict what might happen next.

That predictive element is what turns competitive intelligence from a simple reporting function into a true strategic weapon.

Stage 4: Dissemination and Action

This final stage is arguably the most important. You have to get your insights into the hands of people who can actually do something with them. Intelligence that just sits in a report is completely worthless. How you share your findings is just as critical as the findings themselves.

Effective dissemination means tailoring the message to the audience:

- Executives: They need the big picture and strategic recommendations. A short monthly briefing or a clean dashboard is perfect.

- Sales Teams: They need tactical ammo for the front lines. Think real-time alerts on a competitor's price drop or updated battlecards sent right to their CRM.

- Product Teams: They need the details. In-depth reports on competitor feature releases and deep dives into customer feedback analysis are what they're looking for.

When you deliver timely, relevant, and easy-to-digest insights, you empower your organization to make smarter, faster decisions. This creates a feedback loop that helps refine your KIQs for the next cycle, making your CI process better and more valuable over time.

Choosing the Right Tools for Modern CI

Let's be realistic: in a world overflowing with data, you can't manually track every competitor's move across every channel. It’s simply not possible. This is where technology becomes your competitive intelligence program's engine. The right tools handle the grunt work—the endless data collection—so your team can focus on what really matters: strategic analysis.

Navigating the sea of CI software can feel like a chore, but most tools fall into a few distinct categories. The smartest CI programs don't just pick one; they build a "tech stack" by combining different tools to paint a complete, 360-degree picture of the competitive landscape.

Foundational Monitoring and Aggregation Tools

At the ground level, you have your broad monitoring tools. Think of these as your digital smoke detectors. Platforms like Google Alerts or social listening software are constantly scanning the web for keywords you care about, like competitor brand names, products, or key executives.

They're fantastic for casting a wide net to catch public announcements, news mentions, and the general buzz happening in your market. While they won't give you deep strategic insights on their own, they form an essential first layer, ensuring you never miss a major press release or a sudden shift in customer sentiment on social media.

Specialized Analysis Platforms

Climbing a step up the ladder, we find specialized platforms built for deep, tactical analysis. This is the domain of powerful SEO and content tools like Ahrefs or Semrush. These platforms move beyond simple alerts to dissect a competitor's digital game plan piece by piece. For a closer look, we've broken down some of the best competitive analysis tools in a separate guide.

With these tools, you can finally get concrete answers to crucial questions:

- What keywords are they winning that we're missing?

- Who is linking to their site and giving them authority?

- What specific content of theirs is pulling in the most traffic?

This kind of granular data is pure gold for marketing and sales teams, uncovering exact tactical plays you can run to outmaneuver rivals in search results and content strategy.

The Rise of AI-Powered CI Platforms

The top tier of CI technology is where AI comes into play. These advanced platforms don't just gather data; they make sense of it. They can analyze mountains of unstructured information—like customer reviews or forum posts—to spot hidden patterns and even help you anticipate what a competitor might do next. This is where modern CI delivers its most powerful strategic punch.

Crucially, this new breed of tool is vital for tracking your brand’s visibility in AI-generated search results and chatbot answers. This is a massive blind spot for most companies today. An AI-powered CI platform can tell you how your brand story is being told by generative AI, providing intelligence that is flat-out impossible to find manually.

The market for competitive intelligence tools tells its own story. Valued at USD 0.5 billion in 2023, it’s projected to surge to USD 1.44 billion by 2032. That explosive growth isn't just a trend; it's proof that businesses see these tools as absolutely essential for survival and growth.

Of course, collecting all this great intelligence is only half the battle. To make sure these insights don't get lost in a spreadsheet or a forgotten email thread, successful CI programs often rely on robust knowledge management systems. These platforms act as a central library, making your competitive intelligence easy to find, share, and act on for any team in the company.

Comparison Of CI Tool Categories

To help you visualize where to start, here’s a quick breakdown of how these different tool categories stack up. Each serves a unique purpose, and understanding their strengths will help you build a tech stack that matches your specific intelligence needs.

Ultimately, the "right" tools are the ones that help you answer your most pressing questions. A great approach is to start with a foundational monitoring tool to get your bearings, then layer in specialized platforms to address specific tactical needs.

But for forward-looking strategy and navigating the new frontier of AI search, an AI-powered platform is no longer a luxury—it's a necessity for any business serious about staying ahead of the curve.

Putting Competitive Intelligence into Practice

Frameworks and theories are great, but the real magic of competitive intelligence happens when you put it to work. This is the point where raw data starts to feel like a genuine advantage, shaping the daily decisions that actually move the needle on growth. The best B2B companies don't just hoard information; they weave these insights into the very fabric of their operations.

It’s all about connecting the dots between what you've learned about the market and your rivals to make smarter, faster, and more confident moves.

Uncovering Market Gaps for a Product Launch

Let's say a B2B software company wants to jump into the notoriously crowded project management space. Simply building a product and hoping for the best is a fast track to failure. A smarter approach is using CI to find a strategic opening.

Here’s how they might do it:

- Mine Competitor Reviews: They systematically pull and analyze customer reviews for the top three competitors. They're not just reading them; they're looking for patterns and recurring complaints. A theme quickly emerges: users are constantly griping about clunky integrations and terrible mobile experiences.

- Track Feature Releases: Next, they monitor their rivals' recent product updates. They notice a clear trend—a heavy focus on complex, enterprise-level features that leave small-to-midsize businesses (SMBs) out in the cold.

- Spot the Opening: The intelligence paints a clear picture. There's a glaring market gap for an affordable, mobile-first project management tool with dead-simple integrations, built specifically for SMBs.

This CI-driven approach shifts their product strategy from pure guesswork to a calculated bet, massively improving their odds of a successful launch.

Optimizing Pricing and Sales Strategies

Competitive intelligence is also a secret weapon for your sales team. It gives them the real-time intel they need to close more deals without sacrificing margins.

Think about a common scenario: a sales team keeps losing deals to one specific competitor. The knee-jerk reaction is to lower prices across the board, but that kills profitability. Instead, they use CI to get strategic.

They might uncover that their rival offers a steep discount for annual contracts or throws in a free onboarding package. Armed with that specific insight, the sales team can now craft targeted counter-offers instead of blindly slashing prices. It's a surgical approach that directly counters the competitive threat while protecting the bottom line. To get a real measure of their standing, many teams focus on calculating share of voice to see how their brand presence stacks up against everyone else.

Navigating the New Frontier of AI Search

Perhaps the most crucial modern-day use of CI is managing how your brand shows up in AI-generated search results. When a prospect asks an AI chatbot to compare solutions in your industry, what story is it telling about your company?

In this new era, a B2B company that ignores its brand reputation within AI search is leaving its most valuable asset completely unprotected. Competitive intelligence is the only way to monitor and influence this critical information channel.

Let’s walk through how this plays out. A cybersecurity firm uses a platform like Attensira to monitor what AI models are saying about its brand and products. They discover that a popular chatbot is inaccurately describing their threat detection capabilities, citing an old, outdated article as its source.

This discovery sparks immediate action:

- Content Optimization: The marketing team gets to work creating and promoting new, authoritative content that clearly articulates their advanced features.

- Digital Footprint Correction: They work to get the old source material updated or de-indexed, effectively cleaning up the information AI models are being trained on.

By proactively monitoring and shaping their visibility in AI, they shield their reputation and ensure potential customers get accurate, positive information. They've turned a potential disaster into a competitive edge. This is why the market for competitive intelligence software is exploding, hitting USD 2.5 billion in 2024 and projected to reach USD 6.8 billion by 2033. As this competitive intelligence software market analysis shows, this growth proves just how essential CI has become for companies that need to optimize their AI visibility and marketing ROI.

Navigating the Ethical Boundaries of CI

A powerful competitive intelligence program is built on a foundation of integrity. Knowing where to draw the line between ethical intelligence gathering and illegal corporate espionage isn't just about good practice—it's about protecting your company from very real legal and reputational harm.

The guiding principle is simple: stick to publicly available, open-source information.

Think of it like being a detective. A good detective solves a case by analyzing public records, interviewing witnesses who speak willingly, and examining evidence left out in the open. What they don't do is break into a suspect's house to steal their diary. In competitive intelligence, the "crime scene" is the public domain. Websites, press releases, social media, and industry reports are all fair game.

The moment you have to misrepresent who you are, take something that isn't yours, or violate a confidentiality agreement, you've crossed into espionage. Real competitive intelligence relies on sharp analysis, not shady tactics.

Legal and Reputational Risks to Avoid

Operating in that gray area can have serious consequences. You have to be aware of key legal boundaries like trade secret laws, which protect confidential information such as customer lists or proprietary formulas. Data privacy regulations like GDPR also carry enormous weight. Violating these can result in crippling fines and draining lawsuits.

Beyond the courtroom, the reputational damage from being seen as unethical can be devastating. Trust is one of your most valuable assets, and once it's gone, winning it back from customers, partners, and even your own employees is an uphill battle.

The goal of competitive intelligence is to outthink your competition, not to steal from them. Ethical discipline ensures your insights are built on a sustainable, respectable foundation, protecting your brand while you gather the information you need to win.

A Clear Checklist of Do's and Don'ts

To keep your CI program on the right side of the law, a simple set of guidelines can make all the difference. This checklist isn’t just about avoiding trouble; it’s about building a CI function that commands respect, both inside and outside your organization.

CI Do's - The Ethical Path

- Do rely on publicly available data like news articles, company websites, public filings, and social media.

- Do tap into insights from your own sales and customer success teams about their direct interactions in the market.

- Do attend public trade shows and conferences to learn about what competitors are showcasing.

- Do clearly identify yourself and your company in any direct interactions.

CI Don'ts - The Red Flags

- Don't misrepresent your identity to get information from a competitor.

- Don't ask new hires to disclose confidential information or trade secrets from their former employers.

- Don't try to access non-public areas of a competitor’s digital or physical property.

- Don't use any information that you know was obtained illegally or unethically by a third party.

Got Questions About Competitive Intelligence? You're Not Alone.

Whenever people start digging into competitive intelligence, the same kinds of practical questions always pop up. It's completely normal. Getting these common hurdles out of the way early on is the best way to see the real value of CI and start putting it to work. Let’s tackle some of the most frequent questions I hear.

How Is Competitive Intelligence Different From Market Research?

This is probably the most common question, and it's a good one. While they're related and often get lumped together, they have very different jobs.

Think of it this way: Market research is like drawing the map for an entire territory. It's broad. It tells you how big the market is, what the terrain looks like, who lives there (your customers), and what they generally want. It’s a foundational snapshot.

Competitive intelligence, on the other hand, is about tracking the other players on that map. It’s laser-focused on your rivals—what they’re doing right now, what they’re planning for their next move, and why. It's an active, ongoing mission, not a one-and-done report.

How Can a Small Business Even Start With Competitive Intelligence?

You don't need a Fortune 500 budget or a dedicated department to do CI effectively. The secret for a smaller business isn't about spending more; it's about being focused and consistent. You can get a huge return by concentrating on just a few critical areas.

Here's a simple game plan to get you started:

- Pick 1-2 Key Intelligence Questions (KIQs): Don't try to boil the ocean. Start with something specific and manageable, like, “What kind of messaging are our top two competitors pushing in their latest ad campaigns?”

- Lean on Free Tools: You already have powerful resources at your fingertips. Set up Google Alerts for your competitors' names and products. Manually check their social media feeds and see what their customers are saying.

- Schedule a Weekly Check-in: Block out a couple of hours every week. Go through their websites, read their latest press releases, and look at the jobs they’re hiring for. You’d be amazed at the strategic clues you can find in a job description.

Start small, show some quick wins, and you’ll naturally build a case for investing more into a formal CI program down the road.

What Are the Biggest Mistakes to Avoid in CI?

I've seen a lot of CI programs fizzle out, and it's usually because of a few classic, avoidable mistakes. Knowing what these pitfalls are from day one will help you build something that actually drives results.

The biggest failure in competitive intelligence isn't failing to find the information. It's failing to turn that information into action. Intelligence that just sits in a report is a wasted resource.

Keep these major mistakes on your radar:

- Collecting Data Without a Purpose: Hoarding information without clear questions you need answered just creates noise. You'll end up with a mountain of data that has zero strategic value.

- Suffering from "Analysis Paralysis": It's easy to get so lost in the weeds of data that you never actually produce a single, actionable insight.

- Keeping Intelligence in a Silo: This is the most common killer of CI programs. If the insights aren't shared with the sales, product, and marketing teams who can use them, what's the point?

- Ignoring Ethical Lines: There's a hard line between ethical intelligence gathering and corporate espionage. Crossing it can land your business in serious legal and reputational hot water.

Steering clear of these traps is the key to making sure your competitive intelligence efforts are strategic, useful, and built for the long haul.

Ready to gain a clear advantage in the new era of AI search? Attensira provides the critical intelligence you need to monitor and optimize your brand's visibility in AI-generated responses. See how you stack up against the competition and turn insights into action. Discover your AI visibility with Attensira today.