Learn how to track brand mentions online with our guide. Discover the tools and workflows B2B teams use to manage reputation and find opportunities.

To truly track brand mentions online, you need a system that sees the whole picture. We’re talking about a setup that goes way beyond basic social listening, covering everything from major news sites and niche forums to the new frontier of AI-driven search. This means using specialized monitoring tools to catch every mention of your brand name, products, and even those common misspellings as they happen. The whole point is to turn a firehose of raw data into sharp, actionable intelligence for managing your reputation, outsmarting competitors, and actually connecting with customers.

Why Modern Brand Monitoring is Non-Negotiable

Knowing where and how your brand is discussed has evolved. It’s no longer a vanity metric; it's a core business intelligence function. We live in a world where a single Reddit thread, a conversation in a tiny industry forum, or an answer from an AI chatbot can sway thousands of potential customers. In this environment, passively waiting for mentions to pop up just doesn't cut it anymore. Old-school social listening only catches a tiny fraction of the real conversation.

Genuine brand intelligence demands a proactive stance, one that anticipates where the important conversations will happen next. You have to look beyond the usual suspects like X (formerly Twitter) and Facebook. Today, the critical mentions are often happening in places like:

- AI Search Platforms: How do models like ChatGPT or Google's SGE portray your brand? Are they pulling accurate, up-to-date information or surfacing that one negative review from three years ago?

- Private Communities: Those conversations happening in closed Slack channels, Discord servers, or private Facebook groups are goldmines. They contain unfiltered customer feedback and early signals of market trends.

- Industry Forums: Don't sleep on niche forums and message boards. This is often where the real experts and decision-makers in your field are having high-value discussions.

The Financial Impact of Brand Perception

The value tied up in brand perception is enormous and surprisingly concrete. In 2025, the total value of the world's top 100 most valuable global brands hit an astonishing $10.7 trillion. That's a record high, reflecting a 23% jump from 2022. Tech titans like Apple, Google, and Microsoft dominate this list because they meticulously manage their brands across every digital touchpoint, building consumer trust that cashes out directly on their bottom line.

A brand's value doesn't just live on a balance sheet; it lives in every tweet, review, and AI-generated summary. Failing to monitor these mentions is like letting strangers manage your most valuable asset.

This financial reality is exactly why mastering modern mention tracking is so critical. For example, the top players in the adtech and marketing space are constantly monitoring their share of voice to stay ahead of the pack. You can see how they stack up by checking out detailed industry leaderboards like this one: https://attensira.com/leaderboard?category=adtech-marketing&country=US

Every single untracked mention represents a missed opportunity—a chance to amplify positive feedback, get ahead of a potential crisis, or gather game-changing product insights.

Ultimately, a robust monitoring strategy is about protecting and growing your brand's financial value by giving you control over the narrative. It’s what allows you to join the conversations that matter, understand what customers really think, and make sharp, informed decisions that solidify your place in the market. Without it, you're just flying blind.

Designing Your Brand Tracking System

A powerful brand monitoring system is built on a smart framework, not just a fancy tool. Before you can effectively track brand mentions online, you need a clear blueprint that defines exactly what you’re looking for and, more importantly, why. This foundational work ensures your efforts are focused, efficient, and actually drive business goals.

Think of it like building a net. If the holes are too big, you'll miss valuable catches. If the mesh is too fine, you'll haul in a ton of useless debris. Your tracking system is that net; designing it right means capturing the conversations that matter without drowning in noise.

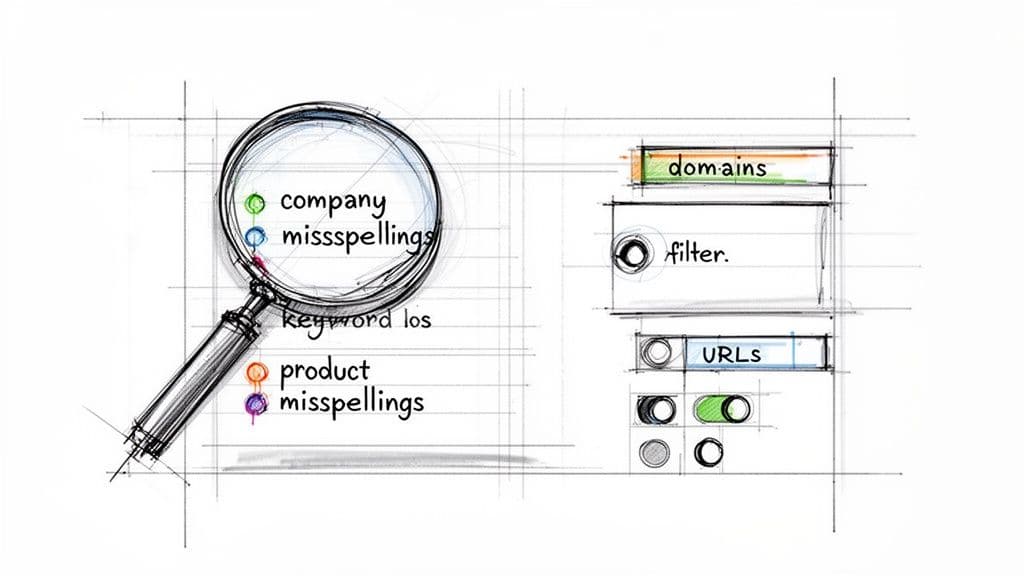

Defining Your Core Tracking Signals

The most obvious place to start is your company name, but a truly effective system goes much deeper. To really understand your brand's footprint, you need to cast a wider net that captures the full spectrum of conversations happening around you.

Here’s where to expand your tracking list:

- Product and Service Names: Don't just track "Apple"; track "iPhone 15 Pro" or "MacBook Air M3." This isolates feedback and sentiment for individual offerings.

- Key Executive Names: Your C-suite and public-facing leaders are brand ambassadors. Their personal brand is deeply intertwined with the company’s reputation.

- Campaign Slogans and Hashtags: How is that new campaign landing? Tracking unique taglines or hashtags gives you real-time performance feedback.

- Common Misspellings and Variations: People make typos. Including common errors (like "Attensira" vs. "Atensira") ensures you catch every mention.

Beyond your own assets, keeping a close eye on your competitors is non-negotiable. Tracking their names, products, and campaigns gives you a vital benchmark for your own performance. You can see their wins, their fumbles, and the conversations they're sparking. For a closer look at how top adtech and marketing brands stack up in the UK, you can dig into the data on pages like https://attensira.com/leaderboard?category=adtech-marketing&country=GB.

This table breaks down the types of signals you should be monitoring, providing a practical framework for building out your tracking queries.

Keyword and Signal Tracking Matrix

Monitoring this mix of signals gives you a far more nuanced and actionable view of your brand's position in the market.

Setting Up Listeners for Specific Channels

Once you know what to track, you have to decide where to listen. Your audience doesn’t live in one place, so your monitoring shouldn’t either. While a broad sweep of the web and social media is a great start, targeted listening in specific online locales often yields higher-quality insights.

Consider setting up dedicated listeners for these high-value areas:

- Key Industry Domains: Identify the top 5-10 news sites, blogs, or trade publications in your niche. Alerting specifically on these domains ensures you never miss a high-authority mention.

- Important Community URLs: Where do your customers really talk? Monitor specific Reddit subreddits, niche industry forums, or Quora topics to tap into raw, unfiltered conversations.

The most valuable insights often come from the places your competitors aren't looking. A single, thoughtful comment on a niche forum can be more telling than a thousand generic social media mentions.

This granular approach lets you focus your resources where they’ll have the biggest impact. A B2B software company, for instance, would get more value from monitoring tech review sites and specific LinkedIn groups than from broad consumer platforms like TikTok. To pull this raw data efficiently, many teams rely on specialized tools and methods; understanding proxies for web scraping data and best practices can be a game-changer here.

The New Frontier: Tracking AI Responses

A major challenge emerging is monitoring how your brand is portrayed in AI-generated answers. When someone asks a chatbot about the "best CRM for small businesses," is your brand in the running? Is the information accurate?

Tracking this requires a whole new mindset. You can't just monitor keywords anymore; you have to monitor the outcomes of specific prompts on platforms like ChatGPT, Perplexity, and Google's SGE. This involves periodically testing key prompts and analyzing the AI's response for brand inclusion, sentiment, and factual accuracy. This is the new edge of reputation management and a critical piece of any modern brand tracking strategy.

From Raw Data to Real Insights

Let's be honest: collecting thousands of brand mentions is the easy part. The real work begins when you’re staring at a mountain of raw data, trying to find the signal in the noise. The initial dump from any monitoring tool can be a chaotic mix of spam, job postings, and conversations that have absolutely nothing to do with your brand.

Before you can even think about analysis, you have to get aggressive with filtering. The goal is to build a clean, high-value feed that lets you focus on the mentions that actually matter.

First, Filter Out the Junk

Think of this as setting up a velvet rope for your data. You need to establish rules that automatically weed out the irrelevant hits. This isn't a one-and-done task; you'll constantly be refining these filters as you go.

Here are the usual suspects to kick out right away:

- Job Postings: Automatically block any mention from domains like LinkedIn Jobs or Indeed. It's also a good idea to create a rule to exclude any URL containing terms like

/jobs/or/careers/. - Spam & Low-Quality Directories: Keep a running blocklist of known spam sites and those awful directory pages that just scrape and republish content without adding any value.

- Your Own Noise: Filter out mentions from your own website, blog, or social channels. Including your own content will only pollute your data and skew your analysis.

- Wrong Context: This one is crucial. Use negative keywords to eliminate mentions where your brand name is used incidentally. For example, if your software company is named "Apollo," you’ll want to exclude conversations that also mention "NASA," "mission," or "spacecraft."

Getting this initial cleanup right is everything. It takes your feed from an overwhelming flood of data to a manageable stream of intelligence.

Score and Prioritize What's Left

Once your data is clean, you can start to figure out what it all means. This is where sentiment analysis and a smart priority scoring system come into play. Most modern tools offer automated sentiment analysis, which will tag mentions as positive, negative, or neutral. It's not a perfect science, but it gives you a quick read on the room.

But here’s the thing: not all mentions carry the same weight. A negative tweet from a brand new account is a blip on the radar. A critical article from a major industry publication is a five-alarm fire. You need a system to tell the difference instantly.

The real value isn't in counting every mention, but in identifying the few that can genuinely shape your brand's narrative. An effective scoring system helps you find the needle in the haystack, automatically.

Your scoring model should be built around a few key factors:

- Source Authority: Mentions from major news outlets, influential blogs, or high-traffic forums get a higher score. Simple.

- Author Influence: Give more weight to mentions from social media users with a large, engaged following.

- Potential Reach: Factor in the audience size or estimated views of the mention.

- Negative Urgency: This is a big one. Automatically flag any mention that combines negative sentiment with high authority or influence. This is your early warning system for a potential crisis.

With a scoring system like this, you can build smart workflows. For instance, any mention scoring an 8/10 or higher could trigger an immediate Slack alert to your PR team. A low-scoring positive mention might just get logged for a weekly report. This is how you move from just collecting data to actively managing your reputation in real time. To see this in action, you can check out leaderboards for the adtech and marketing sector in India to see which brands are making the most noise.

The impact of this kind of focused analysis is massive. In 2025, technology brands accounted for over $2 trillion in global brand value, driven largely by their online presence. Look at NVIDIA—its brand value shot up by 116%, the biggest jump in 25 years, almost entirely because of conversations around AI. It proves that knowing which mentions are actually driving perception is the key to growth.

Building Your Mention Response Workflow

Collecting a mountain of data is one thing; actually doing something with it is another. All the analysis in the world means nothing if the insights just collect dust in a dashboard. This is where a smart, structured response workflow comes in. It's the system that turns your carefully filtered data into coordinated, real-time action, making sure nothing critical ever falls through the cracks.

The goal is pretty straightforward: get the right mention to the right person, right away. When you nail this, you create a closed loop where intelligence directly fuels your next move. No more lag, no more crossed wires.

Designing Your Alerting and Triage System

An effective workflow starts with intelligent alerting. Instead of blasting every single mention into a crowded inbox, you need to set up specific rules based on the priority scoring we talked about earlier. This is your triage process—it ensures your team's time and energy are spent only on what actually matters.

Here’s how that might look in practice:

- High-Priority Negative Mentions: A mention with a high negative sentiment score from a major news outlet or an influential blogger? That should trigger an immediate, multi-channel alert. Think a dedicated Slack channel (

#pr-crisis-alerts) and a direct email to your comms and leadership teams. - Glowing Customer Feedback: A rave review on a popular forum or a glowing comment on social media can be routed straight to the marketing or community teams. This lets them jump in, amplify the user-generated content, and keep the good vibes going.

- Technical Support Questions: A user on Reddit asking a niche question about your API doesn't need to ping the CMO. These technical queries should be funneled directly into a support or product team's workflow, whether that's an Asana project or a Jira ticket, so an expert can give a real answer.

- Hot Sales Leads: Someone on a forum asks, "Which is better, your product or Competitor X?" That's a clear buying signal. This mention should go straight to the sales team's inbox or CRM for immediate follow-up.

This isn't just about reporting anymore. It's about turning your mention feed into an active, intelligent nerve center for the entire company.

A great workflow doesn't just tell you what happened; it tells you who needs to do something about it and right now. It's the bridge between data collection and tangible business outcomes.

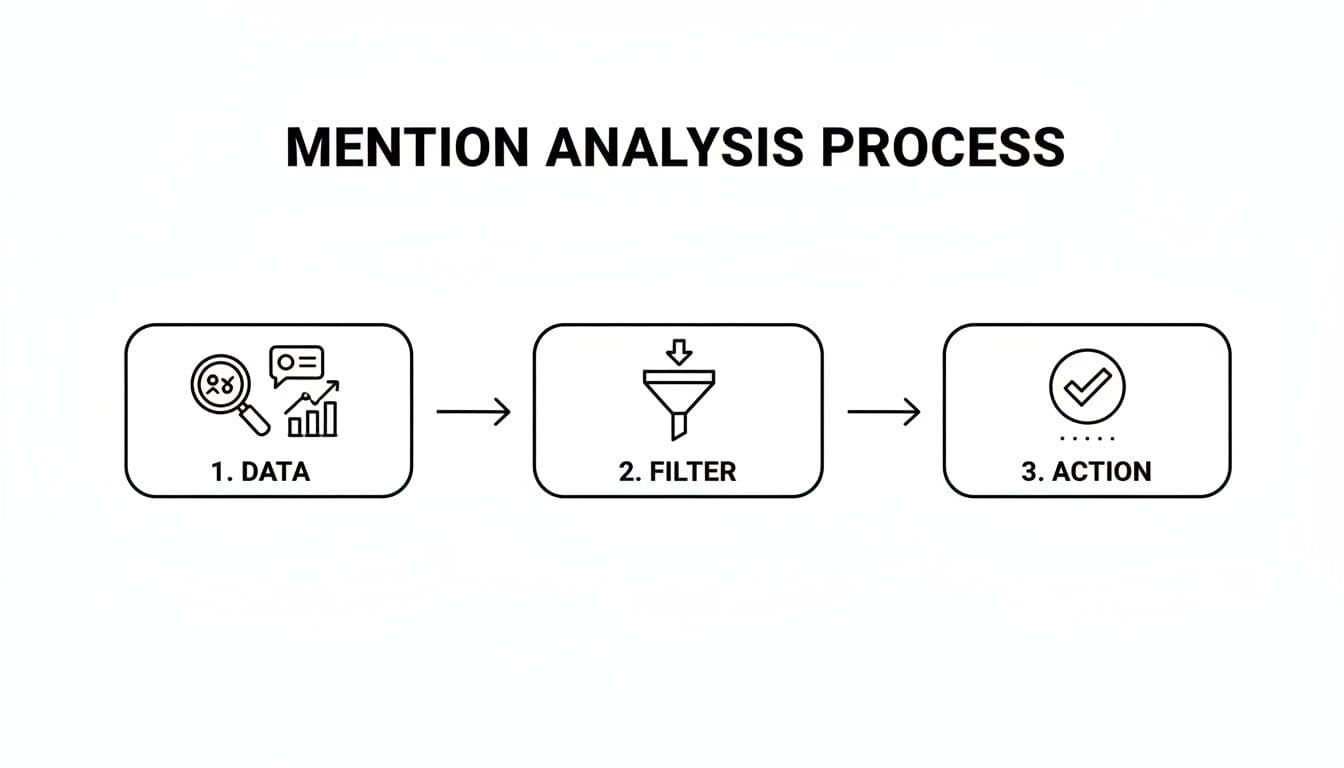

From Alert to Action: A Visual Workflow

To really get this working smoothly, it helps to map out the entire journey from a raw mention to a completed action. The process generally follows a clear path of collection, filtration, and finally, decisive action.

This flowchart shows just how simple—but powerful—this process can be.

The key here is the systematic reduction of noise. At each stage, you're filtering more and more until only the most relevant, high-impact mentions actually land on someone's to-do list.

Integrating with Your Existing Tools

The final piece of the puzzle is integration. Your brand monitoring platform can't be an island. For alerts to be seen and acted on, they need to flow directly into the tools your teams already live in day in and day out.

Most modern monitoring platforms offer native integrations or support webhooks, making these connections seamless.

Here are the most common integration points:

- Team Chat (Slack/Microsoft Teams): Setting up dedicated channels for different alert types is perfect for high-urgency notifications. This keeps critical information visible and makes it easy for the team to discuss it in real-time.

- Project Management (Asana/Trello/Jira): Imagine a mention flagged as a potential feature request automatically generating a new card on the product team’s Trello board. This is how you turn feedback into action without anyone lifting a finger.

- CRM (Salesforce/HubSpot): When an influential figure or a potential lead says something important, you can log that interaction directly in your CRM. This enriches your customer profiles with authentic voice-of-customer data that your sales and marketing teams can use.

By embedding mention alerts into the systems people already use, you remove the friction. Responding becomes a natural part of their daily routine, not some separate, annoying chore. This is what separates a basic monitoring setup from a high-performance brand intelligence engine.

Proving the ROI of Your Brand Tracking Efforts

So, you’ve set up a killer brand tracking program. The alerts are flowing, and the dashboard looks great. But to keep the budget and the buy-in, you have to answer the one question every executive asks: “What’s the return on this investment?”

A dashboard full of mention counts is just noise without context. The real goal is to connect the dots between online chatter and tangible business results. This means breaking down the walls between your monitoring data and the rest of the business intelligence stack, like your CRM and web analytics. Only then can you show how tracking brand mentions actually drives revenue, protects your reputation, and fuels growth.

Tying Mentions to Metrics That Matter

The secret is to translate the raw data from your monitoring tools into the language the C-suite speaks: performance metrics. Instead of just reporting a spike in mentions, you need to show how that buzz correlates with the KPIs that define success for the company.

Here’s where you can start making those critical connections:

- Website Traffic & Conversions: Overlay your mention data with your Google Analytics reports. Can you draw a straight line from a surge in positive mentions during a product launch to a 15% bump in referral traffic? Even better, can you show that traffic led to more demo requests? That’s a story worth telling.

- Lead Generation & Sales Velocity: This is where CRM integration becomes your superpower. When a mention is flagged as a potential sales opportunity and routed to the team, track its lifecycle. Proving that leads sourced from social listening close 20% faster than cold outreach is an incredibly powerful argument for your program's value.

- Share of Voice (SOV) & Market Dominance: Don’t just track your own brand; benchmark your mention volume and sentiment against your top two or three competitors. When you can show a steady quarter-over-quarter increase in your SOV, especially in high-value industry conversations, you’re proving that your brand is actively capturing more market attention and authority.

The most compelling ROI arguments aren't about the quantity of mentions you found. They're about the specific business actions those mentions triggered. Did a single mention help you prevent a PR nightmare? Did it spark a brilliant product idea? Did it help your sales team close a major deal?

This reframes the entire conversation. You're no longer just asking, "How many people are talking about us?" Instead, you're answering, "How is what people are saying impacting our bottom line?"

A Practical Framework for Calculating ROI

While it’s nearly impossible to attribute every last dollar of revenue directly to brand monitoring, you can build a defensible model that quantifies its impact. You’re looking to calculate both direct financial gains and the less-obvious (but hugely important) value of risk mitigation.

Here's a straightforward way to think about it:

- Quantify the Wins: Tally up the direct revenue from opportunities you found. If you sourced 10 leads from tracked conversations that ultimately turned into $50,000 in new business, that’s a direct, undeniable return.

- Value Customer Retention: Keep a log of every instance where your team jumped on a negative comment and saved an at-risk customer. The lifetime value (LTV) of that single retained customer can often pay for your monitoring tools for months.

- Estimate Crisis Aversion: This one is tougher to nail down, but it’s immensely valuable. When an early alert allows you to get ahead of a negative story before it explodes, you’ve averted a potential crisis. Try to estimate the potential cost of that crisis—in lost sales, stock price impact, or brand damage—to show how your system acts as a multi-million dollar insurance policy.

The investment in brand building and monitoring is significant. In the US alone, brand-related spending is projected to exceed $565 billion in 2024. This massive investment is driven by the understanding that online conversations fuel growth, which is why a staggering 92% of marketers plan to maintain or increase their brand awareness budgets. And with data showing it takes 5-7 impressions for a consumer to even remember a brand, proving your tracking efforts are working is more critical than ever. You can explore more data on how brand investment drives market performance.

By consistently tying your monitoring work to concrete financial outcomes, you transform your program from a simple "listening post" into what it truly is: an indispensable engine for business growth and protection.

Your Questions, Answered

As you get started with brand monitoring, some practical questions are bound to come up. Let's walk through some of the most common ones I hear from teams who are just getting their feet wet with tracking brand mentions online.

I'm On a Tight Budget. Where Do I Even Begin?

You don't need a massive budget to get started. Honestly, some of the most effective starting points are completely free, and they can provide a surprising amount of insight.

Your first stop should absolutely be Google Alerts. It costs nothing and is incredibly simple to set up. Just plug in your brand name, key products, or even your CEO's name, and Google will email you whenever it finds new mentions across the web. It's not going to catch every little thing, especially on social media, but as a foundational layer, it's invaluable.

For social channels, you'll have to get your hands a bit dirty. Use the native search functions on platforms like X (formerly Twitter), LinkedIn, and Reddit. A manual search for your brand name can uncover a lot of recent chatter. Sure, it takes time, but it costs nothing and gives you a real, unfiltered look at what people are saying.

What's the Real Difference Between Brand Monitoring and Social Listening?

This is a classic question, and the answer really gets to the heart of why you're tracking conversations in the first place. I always tell people to think of it as being reactive versus being proactive.

- Brand Monitoring is about reacting to the here and now. You're collecting direct mentions of your keywords—your company name, your product, your campaign hashtag. The goal is to jump on things quickly, whether that’s a customer service complaint or a glowing review. It’s all about managing what’s happening to you.

- Social Listening is about proactively seeking insight. You’re looking beyond your own brand to understand the bigger picture: What are the emerging trends in your industry? What are people complaining about with your competitors' products? What unsolicited feedback could inform your next big move?

Monitoring is about the things you know to look for. Listening is about discovering the things you didn't even know you should be asking about.

How Do I See How My Brand Shows Up in AI Search?

This is a new frontier for all of us. You can't just track keywords in AI responses from tools like ChatGPT or Google SGE like you do in traditional search. Because these AI models generate unique answers every time, you have to approach it like a researcher.

First, build a list of questions you think a potential customer would ask an AI. Good examples are things like, "What's the best software for project management?" or "Compare [Your Brand] vs [Competitor]."

Then, you need to periodically run these prompts through the major AI platforms. As you do, document what you find. Specifically, you're looking for:

- Presence: Does your brand even show up in the answer?

- Positioning: Is the information accurate? Does it paint you in a positive light?

- Tone: Does the description align with your key value propositions?

This manual audit is the only way to get a real sense of your brand's narrative in the AI space right now. It will quickly show you where you have content gaps on your own site that you need to fill to influence those future AI responses.

How Often Should I Be Looking at My Brand Mention Reports?

The perfect cadence really depends on how much chatter your brand gets and how fast your industry moves. That said, a tiered system seems to work best for nearly everyone.

For the day-to-day stuff, you need real-time alerts for anything that could be a potential crisis. That’s non-negotiable. But for looking at the bigger picture, a weekly or bi-weekly review is the sweet spot.

That rhythm helps you identify trends and sentiment shifts without getting bogged down in every single mention. From there, a comprehensive monthly report is perfect for sharing insights with leadership and making sure your monitoring strategy is still aligned with your company’s goals.

Ready to see how your brand appears in AI search and take control of the conversation? Attensira provides the specialized tools you need to monitor and optimize your presence on the platforms that matter most. Start tracking your AI visibility today at https://attensira.com.