Learn exactly what keywords are my competitors using with our proven guide. Uncover their SEO strategy, find content gaps, and start outranking them today.

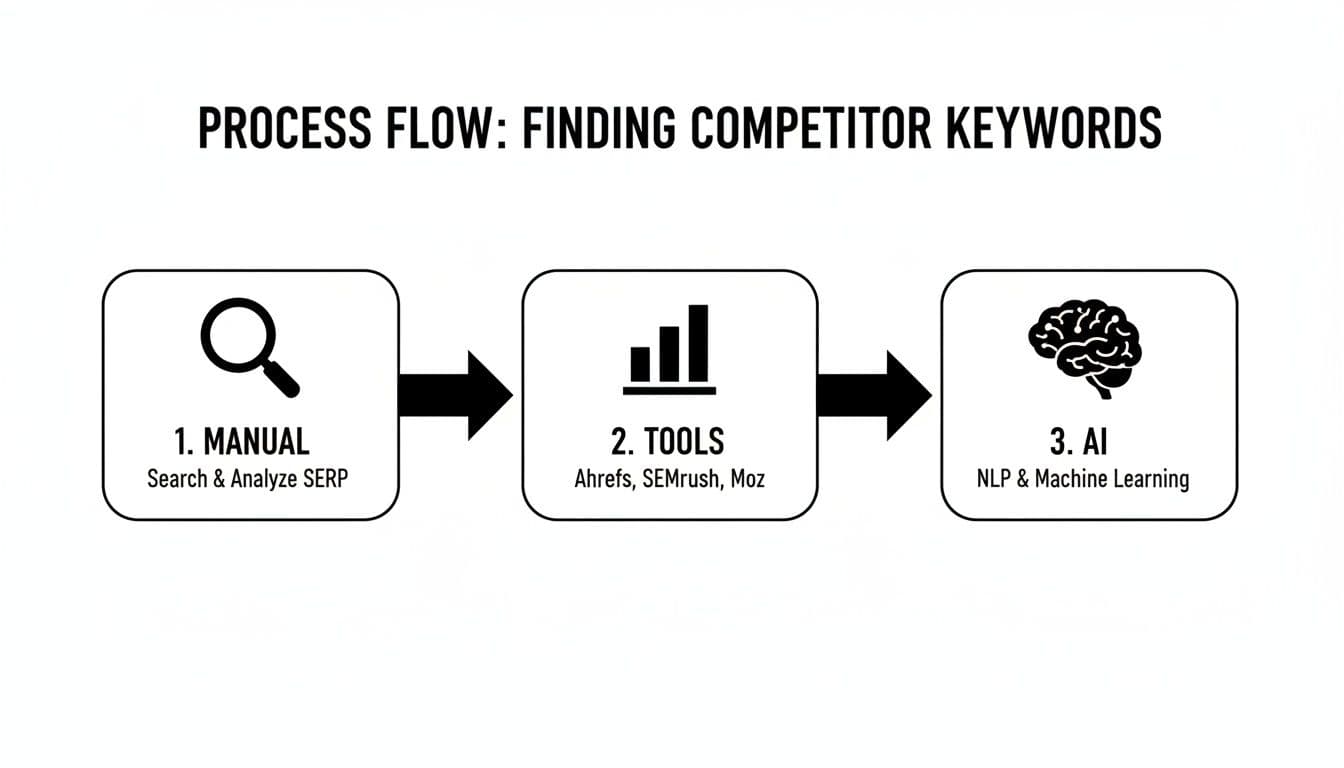

Figuring out which keywords your competitors are targeting isn't just a one-off task. It’s a process that blends old-school manual detective work with the brute force of modern SEO tools and the nuanced insights from AI. The goal isn't just to see their top-ranking terms; it's to map out their entire keyword strategy, find the gaps, and use that intel to your advantage.

A Framework for Uncovering Competitor Keywords

Before you jump into a tool like Ahrefs or Semrush, it helps to have a clear plan. Answering "what keywords are my competitors using?" goes way beyond a simple list of popular phrases. You're trying to understand their entire keyword ecosystem—the thousands of terms that fuel their traffic and reveal where they're placing their bets.

To get the full picture, we'll walk through three distinct methods. Each one gives you a different piece of the puzzle.

The Three Core Methods for Competitor Keyword Discovery

A solid analysis never relies on just one source of information. You need to combine quick, qualitative insights with deep, quantitative data to see what's really going on. Relying on a single method is a surefire way to miss critical parts of your competitor's strategy.

The table below breaks down the three essential approaches we'll cover. Think of them as layers of intelligence, with each one building on the last.

This combination is powerful. You start with manual checks for context, use SEO tools to gather the hard numbers, and then layer on AI to find the subtle opportunities everyone else is overlooking.

This flow diagram shows how these methods work together to give you a complete picture.

Starting with a manual review gives you the "why" behind the data. That context makes the numbers from your SEO tools much more meaningful, and AI helps you synthesize it all into a smart, forward-looking strategy.

Think Ecosystems, Not Just Keywords

It's a classic mistake to focus only on a handful of high-volume "head" terms. The reality is much bigger.

The big SEO platforms track tens of billions of keywords for a reason. Most searches are long-tail—those longer, highly specific phrases that make up an estimated 70% of all search traffic. This means a proper analysis should look at thousands of keywords for each competitor, not just the top 10. You need to group them by intent (informational, commercial, etc.) to truly understand the strategy.

A competitor's true keyword strategy isn't defined by the top 10 keywords they rank for. It's revealed in the thousands of long-tail, high-intent phrases that capture niche audiences and drive qualified traffic at every stage of the funnel.

Ultimately, you’re building a complete intelligence report. A great next step is to perform a content gap analysis for SEO, which specifically flags keywords your competitors rank for but you don't. For a wider view on integrating this into your overall strategy, check out our guide on https://blog.attensira.com/how-to-do-competitor-analysis-in-seo.

Manual Discovery for Quick Wins

Before you even think about firing up expensive SEO software, you can learn a ton about what your competitors are up to with a little old-fashioned detective work. Seriously, all you need is your browser. These hands-on techniques give you quick, practical insights and help you form an initial hypothesis about their keyword strategy before spending a dime.

Think of it as digital reconnaissance. You're observing your competition in their natural habitat—the search results—and on their home turf, their website. This is often where you'll spot the strategic details that automated tools can't quite grasp.

The best part? These methods are fast, free, and build the perfect foundation for a smarter competitor analysis down the line.

Perform a Manual SERP Audit

Your first stop is the search engine results page (SERP). To get a clean look, always open an incognito or private browsing window. This simple step strips away your personal search history and location bias, showing you what a fresh user would see.

Start by searching for your main target keywords—the big, obvious terms that define your space. If you sell project management software, you'd start with something like "b2b project management tools" or "agile software for small teams."

But don't just glance at who's ranking. You need to dig into how they are ranking by looking closely at a few key elements:

- Page Titles: Pay attention to their phrasing. Are they using modifiers like "Best," "Free," or "Alternative"? This is a direct signal of the search intent they're trying to capture.

- Meta Descriptions: Look for persuasive copy and calls-to-action. These little blurbs often pack in secondary keywords and reveal the unique value they're pushing for that specific query.

- URL Structures: Clean, keyword-rich URLs (like

competitor.com/features/time-tracking) are a dead giveaway of a page's core topic and tell you a lot about their site's architecture.

Just this quick audit alone can reveal your competitors' on-page priorities and how they angle their content to win clicks on those crucial industry terms.

Reverse-Engineer Their Website Content Strategy

Once you've scoped out the SERPs, it's time to head straight to the source: your competitors' websites. The goal here is to reverse-engineer their content pillars—the major topics they're trying to own. This is where you'll uncover the clues to their long-tail keyword strategy.

A competitor’s blog categories, navigation labels, and FAQ sections are a public roadmap of their keyword strategy. They are explicitly telling you which broad topics and specific user questions they consider most valuable to their business.

Start with their main navigation and footer menus. The words they use for products, solutions, and resources are almost always aligned with high-value, commercial-intent keywords. From there, your next stop should be their blog or resource center.

Here’s where to look on a competitor's site:

- Blog Categories and Tags: This is basically a cheat sheet for their content strategy. If you see categories like "Lead Generation," "Sales Automation," and "Customer Retention," you know these are the keyword clusters they are building content around.

- Sitemap: Most sites have an XML sitemap, which you can usually find by adding

/sitemap.xmlto their domain. It might look like a giant, messy list, but a quick scan of the URLs gives you a full inventory of their pages, often revealing content hubs you might have missed otherwise. - FAQ Pages: This is a goldmine for question-based keywords. An FAQ page directly addresses their audience's pain points, giving you a ready-made list of informational keywords. For example, you might find a question like, "How do I integrate CRM with email marketing?"—a perfect high-intent query you can target.

By manually checking these areas, you move from guesswork to building a data-informed picture of what your competitors are really focused on, all without needing any special tools.

Using SEO Tools for a Deep Dive Analysis

Manual checks are a great starting point, giving you a real feel for a competitor's on-page strategy. But let's be honest, they just don't scale. If you really want to understand the entire universe of keywords driving their traffic, you need to bring in the heavy hitters: dedicated SEO tools like Ahrefs, Semrush, or Moz.

Think of it like this: shifting from manual checks to a full-blown tool analysis is like trading a magnifying glass for a high-powered microscope. You’re no longer just glancing at the surface. You're diving deep into the data to map out the entire keyword ecosystem that fuels your competitor's organic success.

Mastering Keyword Gap Analysis

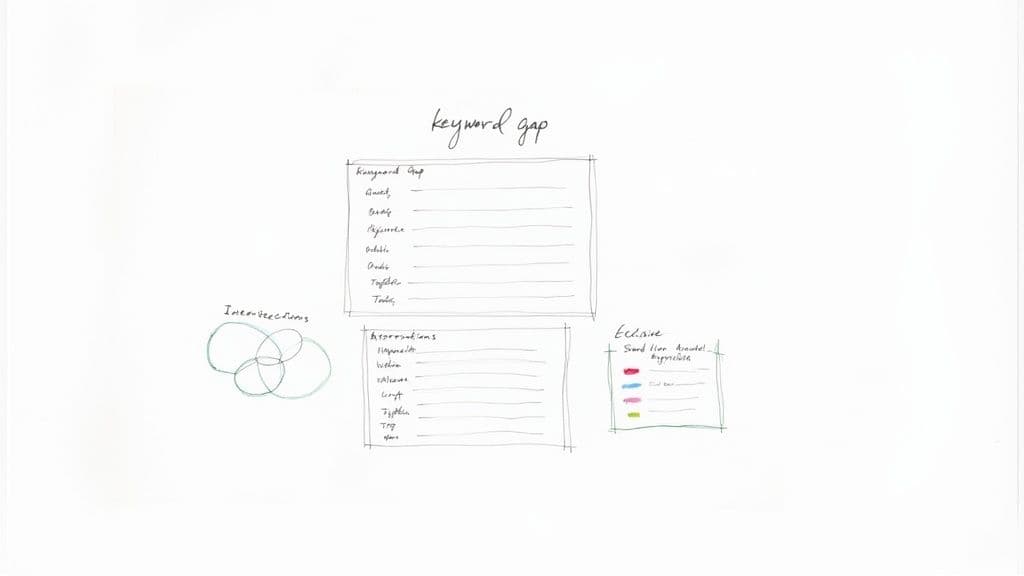

One of the most powerful features you'll find in any of these platforms is the Keyword Gap analysis (sometimes called "Content Gap"). Its job is simple but brilliant: it directly compares your website against your competitors' to show you exactly where the keyword opportunities lie. The result is a clean, actionable list that reveals where you overlap and, more importantly, where you're getting left behind.

This kind of analysis usually breaks down the keywords into a few buckets:

- Shared: These are the keywords where you and your competitors are both in the ring, duking it out for rankings. It’s your list of head-to-head battlegrounds.

- Missing: This is the goldmine. These are all the keywords your competitors rank for, but you don't. It’s a ready-made list of new content ideas and strategic gaps.

- Weak: Here, your competitor is significantly outranking you for the same terms. These are your prime targets for content refreshes and optimization pushes.

- Strong: Keywords where you have the upper hand. You'll want to keep an eye on these to make sure you defend your turf.

By zeroing in on the "Missing" and "Weak" categories, you get a data-backed, prioritized list of terms to go after. No more guessing.

Interpreting the Data from a Keyword Gap Report

Running a keyword gap report is the easy part. The real skill is in turning that mountain of raw data into a smart, winning strategy. A single report can spit out thousands of keywords, which is enough to make anyone's head spin. The trick is to filter and segment the list to find the actual gems.

Here’s a snapshot of what a Semrush Keyword Gap report looks like. It gives you a great visual of the keyword overlap between you and your competition.

This kind of visualization instantly highlights the shared terms and unique opportunities for each site you're analyzing. From here, you can dig into the specific lists and start planning your attack.

Keep in mind that different tools have different capabilities. Some platforms let you compare up to five domains at once, potentially returning millions of keywords. Free versions might only give you 5–15, while enterprise plans unlock the full firehose. And because each tool crawls the web and builds its own data index, you might see a competitor has 10,000 keywords in one tool but only 6,000 in another. It's smart to treat these numbers as solid estimates and give more weight to keywords that pop up across multiple tools.

From Raw Data to Actionable Insights

With your list in hand, it's time to find the signal in the noise. It’s tempting to just sort by search volume, but that’s often a mistake. High-volume terms are usually hyper-competitive and might not even align with what you're trying to achieve. Instead, you need to apply some strategic filters to surface the best opportunities.

My process for filtering usually involves a few key steps:

- Filter by Keyword Difficulty (KD): I always start by looking for keywords with a lower KD score. These are your "quick wins"—the low-hanging fruit where you can potentially rank faster without a massive effort.

- Filter by Search Intent: Next, I hunt for commercial or transactional terms. Look for modifiers like "alternative," "pricing," "review," or "vs." These signal that a searcher is much closer to making a decision.

- Filter by Ranking Position: I focus on keywords where my competitor is ranking on page one (positions 1-10), but my site is languishing on page two or beyond. Sometimes, a small optimization push is all it takes to jump into a much more valuable position.

A massive list of competitor keywords is just noise until you apply strategic filters. The real value isn't in the quantity of keywords you find, but in your ability to identify the handful of high-intent, low-difficulty terms that can deliver immediate traffic and business impact.

This filtering process turns a daunting spreadsheet into a focused, prioritized action plan. It helps you put your resources where they’ll make the biggest difference, instead of just chasing vanity metrics. You might also want to explore how AI-powered SEO tools can help automate some of this filtering and get you to the insights even faster.

Identifying Keyword Intersections and Exclusive Terms

Beyond just plugging gaps, it's incredibly useful to understand two other keyword relationships: intersections and exclusive terms.

- Keyword Intersections are the terms where you and your competitors are both actively competing. Digging into these reveals the core battleground in your niche. Are they consistently outranking you? Is their content simply better? This analysis will tell you exactly where to focus your on-page SEO and content improvement efforts.

- Exclusive Keywords are terms that your competitors rank for that are completely unique to them (at least among the sites you analyzed). These often shine a light on a specific niche they're carving out or a new content pillar they're trying to build. Are they talking to a new audience? Targeting a different part of the buyer's journey? Finding their exclusive keywords can tip you off to a strategic pivot you would have otherwise missed.

This level of analysis takes you from simply asking "what keywords are they using?" to truly understanding the why behind their strategy. It’s that deeper insight that allows you to not just react, but to anticipate their next move and proactively claim your own territory in the SERPs.

Finding High-Intent Keywords in Paid Ads

While organic search shows you a competitor's long-game, their paid ads reveal what's making them money right now. When a business opens its wallet to bid on a keyword, it's a massive tell. It means that term almost certainly converts. This makes digging into their PPC strategy a shortcut to finding out what keywords your competitors are using to land paying customers.

Think about it. Organic content can be for brand awareness, education, or just building topical authority. Paid ads? They almost always have one goal: generate a profitable return. By reverse-engineering their ad campaigns, you get a pre-vetted list of keywords that drive action.

Decoding Ad Copy for Keyword Clues

Start by simply reading the ads. Look at the language your competitors are using in their headlines and descriptions. This copy isn't accidental; it’s carefully written to connect with a specific audience and solve a very particular problem.

Tools like Semrush or SpyFu are great for this, letting you pull up a competitor’s current and past ad creative. You’re looking for patterns. Are they always talking about a certain feature? Pushing a discount? Using urgent calls-to-action? This language points directly to the user pain points they’re targeting and what they believe drives clicks.

For instance, an ad headline like "Tired of Manual Invoicing? Automate Today" is a dead giveaway. They’re bidding on keywords around "manual invoicing problems," "bookkeeping automation," or "accounting software alternatives." The ad itself is a map leading straight to the keywords that trigger it.

Uncovering the Keywords They Pay For

Beyond just reading the creative, you can get straight to the source. The right tools will show you exactly which keywords your competitors are bidding on, cutting out all the guesswork. This data is pure gold because you see which terms they value enough to spend money on. It’s a direct look into their paid acquisition playbook. You can find some excellent strategies for finding competitor PPC keywords to get a head start.

As you build a list of these paid terms, keep an eye out for keywords with strong commercial modifiers:

- Pricing: Terms like "[competitor] pricing" or "[product category] cost."

- Alternatives: Phrases such as "[competitor] alternative" or "software like [competitor]."

- Comparisons: Search queries like "[competitor] vs [your brand]" or "compare [product category] tools."

- Reviews: Anything like "[competitor] reviews" or "best [product category] software."

These keywords scream bottom-of-the-funnel. The searcher is done with research and is actively weighing their options, ready to make a decision. Understanding the nuances here is key, and you can learn more by exploring our guide on what is search intent.

A competitor’s paid keyword list isn’t just data; it's a financial statement of their marketing priorities. The terms they consistently spend money on are the ones proven to drive conversions and revenue for their business.

This intel is doubly useful. First, it hands you a proven list of keywords to consider for your own PPC campaigns. Second, it highlights high-value topics you can target with organic content—think detailed comparison posts or honest review articles. That way, you can capture that same high-intent traffic without having to pay for every single click.

How to Turn Competitor Insights Into a Real Action Plan

Finding a huge list of your competitors' keywords feels like a major win. But here's the hard truth: a massive spreadsheet of terms is just raw data. It doesn't do anything for your rankings or traffic until you turn it into a concrete plan.

This is where the real work begins. You have to move from just collecting data to making smart, strategic decisions. A list of a thousand keywords is overwhelming and will likely lead to chasing shiny objects. A prioritized action plan, on the other hand, is how you actually start winning.

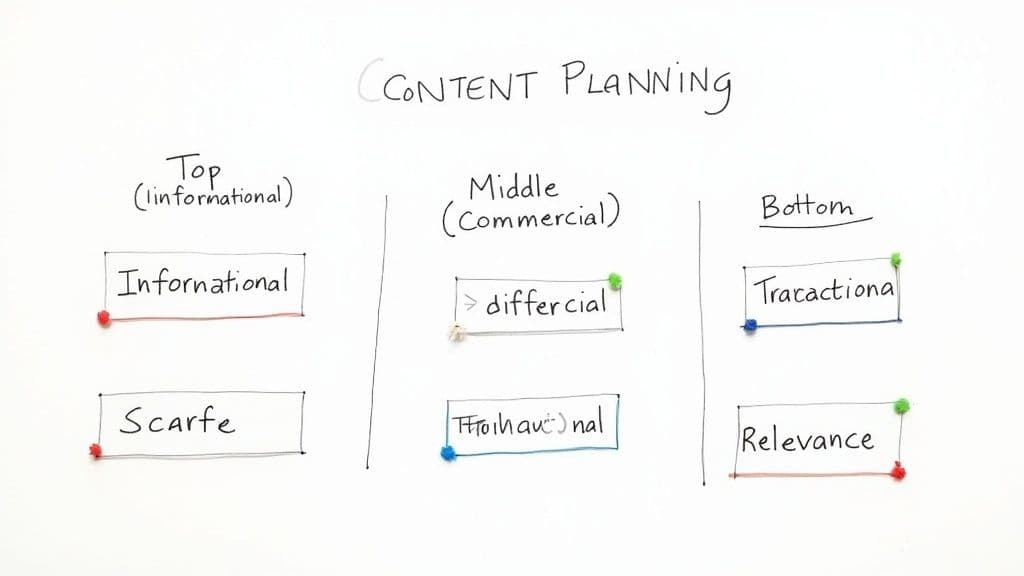

Start by Sorting Keywords by User Intent

The very first thing I do with a fresh list of competitor keywords is group them by user intent. You can't treat every keyword the same. Someone typing "what is project management software" is in a completely different headspace than someone searching for "best Asana alternatives."

Sorting them into these buckets helps you map everything to the customer journey and figure out what kind of content you need to create.

- Informational Intent: These are the "what," "how," and "why" questions. People are in research mode, just looking for answers. This is prime territory for blog posts, in-depth guides, and tutorials.

- Commercial Intent: Now they're weighing their options. Searches often include words like "best," "review," "vs," or "alternative." Your job here is to create compelling comparison pages and unbiased product reviews.

- Transactional Intent: This person has their wallet out. They're searching for things like "pricing," "demo," "free trial," or even specific product names. Your landing pages and feature pages need to be laser-focused on these terms.

Once you've segmented your competitor's list, you get a clear picture of their strategy. Are they all-in on top-of-funnel content, or are they duking it out for those high-value commercial keywords? This is how you spot the gaps and find your opening.

Build a Scoring Model to Find the Gold

With your keywords neatly categorized, you still need to decide where to focus first. Trying to tackle everything at once is a classic mistake that burns through resources with little to show for it. I always use a simple scoring model to separate the quick wins from the long-term plays. It takes the guesswork out of prioritization.

You can build this right in a spreadsheet. The goal is to score each keyword against a few key metrics, turning a subjective "what should we write about?" conversation into an objective, data-backed decision.

A scoring model removes emotion from your content strategy. It forces you to prioritize keywords based on a calculated blend of search volume, difficulty, and business relevance, ensuring every piece of content has a clear, strategic purpose.

Here’s a look at a basic framework I use. It's a great starting point, and you can tweak the weights to fit your own goals.

Keyword Opportunity Scoring Framework

This is a sample scoring model to help prioritize competitor keywords based on key metrics. Users can adapt this framework to their specific business goals.

You just run each keyword through this model, apply your weights, and you'll get a final "Opportunity Score." Sort your list by that score, and voilà—you have a data-driven content roadmap.

From a Scored List to a Content Calendar

That prioritized list is now the backbone of your content calendar. The real value of knowing what keywords your competitors are using is that you can now quantify the potential return on your efforts.

When you uncover these keywords, you also get metrics like their share of search, estimated organic traffic, and the term's commercial value (which you can often gauge by its CPC). We know from industry data that roughly 69% of clicks go to the top five organic results, which makes the prize for ranking pretty clear.

Let's say a keyword gap report shows your competitor ranks for 1,200 valuable commercial keywords. You can now estimate how many monthly visits you could realistically capture by targeting them. For terms with a high CPC, you can decide whether to compete with ads or invest in long-term organic content.

This process allows marketing teams to turn a raw keyword list into a solid ROI forecast. You can focus on the top 10-20% of keywords that will drive the most significant impact. To see how different tools can help with this, you can find a deeper dive into competitor analysis tools and their capabilities.

Your highest-scoring keywords are your immediate priorities. Get them assigned to writers, plug them into your editorial schedule, and start tracking their performance. This is how you move from just analyzing the competition to proactively and systematically taking their market share.

Common Questions About Competitor Keyword Analysis

As you start digging into what keywords your competitors are using, you'll inevitably run into a few common questions. Let's tackle them head-on, so you can move forward with a clear, confident strategy.

How Often Should I Analyze Competitors’ Keywords?

The real answer is, "it depends," but here's a practical framework that works for most.

I recommend doing a comprehensive deep-dive every quarter. This timing is the sweet spot—it’s frequent enough to catch major strategic shifts, like a competitor launching a new product or a major content initiative, without getting bogged down in daily noise.

For your top three to five direct rivals, however, a lighter monthly check-in is a smart move. This helps you spot new content pushes or changes in their paid ad strategies almost as they happen. In really fast-moving industries, you might even want to track a handful of high-value keywords weekly. You never want to be caught off guard by a sudden ranking change or an aggressive new campaign.

What if My Competitor Is a Much Larger Brand?

This is a classic David vs. Goliath scenario, and it’s an opportunity, not a dead end. Trying to compete head-on for their most valuable, high-volume keywords is a surefire way to burn through your budget and morale. The smarter play is to find and exploit the gaps they overlook.

Use your keyword gap analysis to pinpoint the long-tail, lower-difficulty terms they rank for but don't actively target. These are often question-based queries or hyper-niche informational topics that a huge brand might consider too small to bother with. By creating superior, focused content for these terms, you can build authority and attract a highly qualified audience.

When facing a larger competitor, don't play their game. Change the battlefield. Focus on the niche, long-tail keywords they ignore to build your authority and traffic base from the ground up.

Don't forget to look at their paid keywords, too. You can often win organically on terms where they're forced to spend ad dollars, giving you a huge, cost-effective advantage.

Are Traffic Estimates from SEO Tools Accurate?

Think of traffic estimates from tools like Ahrefs or Semrush as directional guidance, not gospel truth.

These platforms can't peek into your competitor's private Google Analytics account. Instead, they rely on a mix of public data—like estimated search volumes and average click-through rates (CTR) for a given ranking position—to calculate those numbers.

Their real value is in comparison and relativity. If a tool estimates a keyword drives 10,000 visits for your competitor, the key takeaway isn't the exact number. It’s the fact that this keyword is a significant traffic driver for them. Focus on the relative importance of keywords in their profile, not the precise traffic figure.

Should I Just Copy My Competitor's Keyword Strategy?

In a word: no. Your goal here is analysis and adaptation, not imitation. A copycat strategy ensures you’ll always be one step behind, constantly reacting instead of leading.

Use their keyword list as a source of market intelligence. It reveals their priorities, helps you spot gaps you can own, and shows you opportunities to create something better—whether that’s more comprehensive, more engaging, or more targeted content.

Your brand's unique voice, expertise, and value proposition are what will ultimately win you the audience. Use their data for inspiration, then go build something undeniably superior. That’s how you go from being a follower to a leader in your space.

Ready to see how your brand shows up in AI-driven search? Attensira provides the insights you need to optimize your content for tomorrow's search engines. Connect your domain in seconds and start tracking your AI visibility to stay ahead of the competition. Get started with Attensira today!