Unlock sustainable growth with our guide to customer acquisition cost calculation. Learn the formulas, strategies, and B2B SaaS metrics you need to master.

At its most basic, the customer acquisition cost calculation is a pretty simple formula: you take your total sales and marketing costs for a given period and divide that by the number of new customers you acquired in that same timeframe. But don't let the simple math fool you; this single number is the bedrock for understanding just how much you have to spend to win each new client.

Why Accurate Customer Acquisition Cost Calculation Matters

In the high-stakes game of B2B and SaaS, letting your acquisition spending run wild is a quiet but lethal way to kill a business. The core formula might seem straightforward, but the story it tells is anything but. This isn't just about crunching numbers; it's about survival and building a foundation for sustainable growth. A precise CAC calculation is the diagnostic tool that shows you the true health of your entire go-to-market strategy.

Without this metric, you’re flying blind. You're just pouring money into different channels, hoping something sticks, without any real idea of the return. This guide is designed to cut through that noise and focus on the one critical metric that so often separates the companies that scale from those that flame out.

The Foundation of Sustainable Growth

Getting a handle on your CAC is really about understanding the delicate balance between what you spend and the value you get back. It's the number that directly impacts all the other critical metrics that investors, board members, and your own leadership team are watching like hawks.

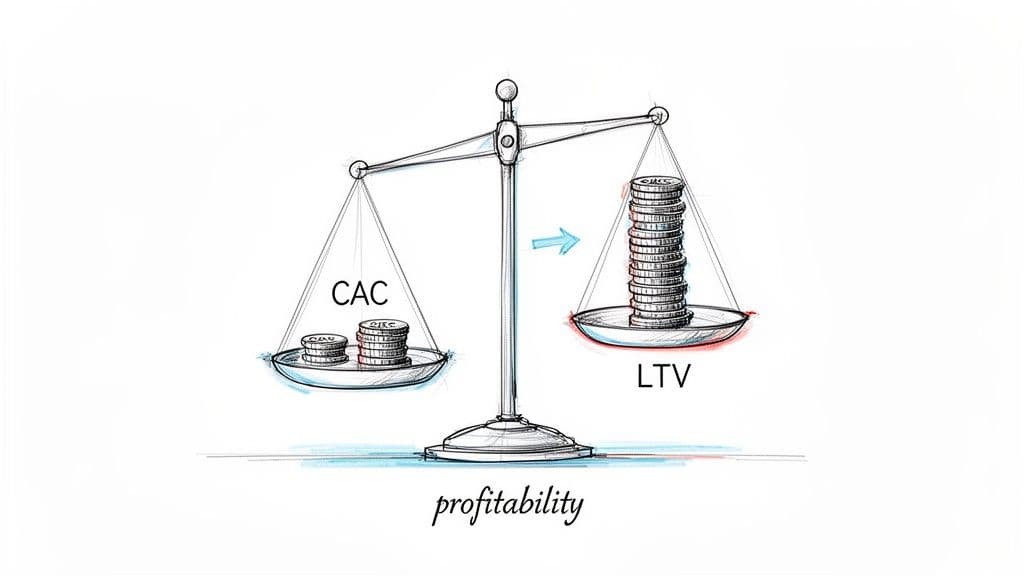

- Profitability: This is the big one. At its core, CAC tells you if your business model actually works. If it costs more to acquire a customer than you'll ever earn from them, you're on a fast track to failure. It's as simple as that.

- Capital Efficiency: It reveals how effectively you’re using your cash to bring in new revenue. This is a massive concern for everyone, from bootstrapped startups to venture-backed scale-ups.

- Strategic Decision-Making: When you know your CAC, you can make smarter decisions with confidence. You can double down on successful campaigns, allocate budgets intelligently, and pull the plug on underperforming channels before they become a serious drain.

The real goal here is to build a predictable, repeatable engine for growth. Knowing your CAC isn't just a nice-to-have; it's the first, non-negotiable step in building that machine. It’s what turns marketing from a cost center into a measurable investment.

The B2B and SaaS Reality

For B2B SaaS companies, the stakes are even higher. The sales cycles are long, often stretching over months and involving a whole committee of decision-makers. This complexity drives up costs significantly. As of 2025, the average customer acquisition cost in this sector has climbed to around $1,200 per customer. When you plug that into the simple formula, you quickly see just how resource-intensive B2B growth can be. You can find more data on B2B CAC trends from Phoenix Strategy Group.

This environment makes a precise calculation absolutely critical. Unlike a one-click e-commerce purchase, a SaaS CAC has to account for a complex, multi-touch journey. As we'll get into, new AI-driven search tools from platforms like Attensira are changing the game here, making efficient spending and clear measurement more important than ever.

Auditing Your True Sales and Marketing Spend

To get a customer acquisition cost you can actually trust, you have to look way beyond your ad spend. The real number is often buried in a dozen different line items on your P&L, and a rigorous audit of every dollar spent is the only way to unearth it.

Think of it as financial detective work. You’re not just adding up the obvious bills; you're hunting down all the hidden expenses that quietly inflate your true CAC. So many companies accidentally under-report their acquisition cost because they forget to account for the full cost of the people and tools making it all happen.

Identifying Every Cost Center

The first layer of expenses is usually pretty easy to spot—direct costs tied to specific campaigns. But a real audit means digging much deeper into your operational spending.

Here’s a practical breakdown of where to look:

- Paid Media Spend: This is the most straightforward. It’s everything you spend on platforms like Google Ads, LinkedIn Ads, social media advertising, and sponsored content.

- Content Production: Don’t forget what it costs to create the assets you’re promoting. This means freelance writer fees, video production, graphic design software, and any agency retainers.

- Events and Sponsorships: Booth fees for trade shows, travel and lodging for the team, and the cost of sponsoring industry webinars all belong here.

Once you have the direct expenses down, it's time to account for the internal resources that power your acquisition engine.

Calculating Fully-Loaded Team Costs

One of the most common mistakes I see is companies only including base salaries in their CAC calculation. This will always give you a deceptively low number. To get a real sense of your investment in each team member, you need to calculate their "fully-loaded" cost.

To get this right, you need to add up:

- Gross Salaries: The base pay for everyone on your sales and marketing teams.

- Commissions and Bonuses: All performance-based pay tied directly to bringing in new customers.

- Benefits and Payroll Taxes: This includes health insurance, retirement plan matches, and employer-side taxes. This bucket alone can easily add 20-30% on top of an employee's salary.

What if an employee splits their time? For instance, a content marketer might write blog posts to attract new leads but also create a newsletter for existing customers. In that case, you have to allocate their cost proportionally. If they spend 70% of their time on acquisition-focused work, you’d include 70% of their fully-loaded cost in your CAC formula.

A precise CAC isn't just an academic exercise; it's a direct reflection of your operational efficiency. Overlooking even 10% of your costs can lead to a dangerously skewed perception of your business's health and scalability.

Tallying Up Your Martech and Overhead

Your technology stack is another major cost center. Every tool that helps your sales and marketing teams do their jobs needs to be included in the audit.

This typically includes:

- CRM Software (e.g., Salesforce, HubSpot)

- Marketing Automation Platforms (e.g., Marketo, Pardot)

- Analytics Tools (e.g., Google Analytics 360, Mixpanel)

- SEO Software (e.g., Ahrefs, Semrush)

Finally, you have to allocate a fair portion of your general business overhead. It might seem indirect, but things like office rent, utilities, and administrative support are essential for your acquisition teams to function. A common approach is to allocate overhead based on headcount. If your sales and marketing teams make up 40% of your company's total employees, then 40% of your monthly overhead costs get attributed to CAC.

To keep these numbers straight and avoid manual errors, it helps to use the right tools. You might want to explore some of the best business expense tracking apps to make this process much simpler.

Putting It All Together: A Practical Example

Let's walk through a simplified monthly P&L for a hypothetical SaaS company to see this in action. For a more detailed look at measuring specific campaign inputs, check out our guide on measuring marketing campaign effectiveness.

Here’s what a spreadsheet breaking down these costs might look like.

This kind of spreadsheet helps pull all the disparate costs into one clear view, making the final calculation straightforward.

Let’s plug in some numbers for one month:

Now, let's say this company acquired 100 new customers during that same month. The calculation is simple:

120,000 (Total Costs) / 100 (New Customers) = 1,200 CAC

This fully-loaded CAC gives you a much more realistic picture of what it truly costs to win a new customer. Armed with this number, you can make far more informed decisions about your budget, strategy, and overall growth.

Segmenting CAC for Deeper Strategic Insights

A single, blended customer acquisition cost gives you a 30,00-foot view, but the real strategic wins are found on the ground. Relying on one average number is like trying to navigate a city with a map of the entire country—you get the general idea, but you can’t see the actual streets. Real growth happens when you start segmenting, which uncovers which channels are driving profitable growth and which are just draining your budget.

This approach takes you beyond a simple formula and into a much more granular understanding of your acquisition engine. Instead of a single, potentially misleading average, you start seeing the individual performance of each part of your marketing machine. This is where you can make data-backed decisions that really move the needle.

Calculating CAC by Marketing Channel

The most powerful and immediate way to segment your CAC is by marketing channel. This lets you directly compare the efficiency of your Google Ads campaigns against your organic content marketing or paid social efforts on LinkedIn. The goal is to isolate the costs and the customers associated with each specific channel.

The formula is a straightforward variation of the basic one:

Channel CAC = Total Marketing & Sales Spend for a Specific Channel / New Customers Acquired from That Channel

To get this right, you have to be meticulous about tracking both your spending and your customer sources.

- Paid Channels: This is usually the easy part. Just sum up your total ad spend on a platform for the period.

- Organic Channels: This gets a little trickier. You need to allocate a portion of your content team's salaries, SEO tool subscriptions, and any freelance writer costs. A common method is to assign these costs based on the percentage of time your team spends focused on that channel.

Let's look at a quick example. Imagine a SaaS company spent 20,000** on Google Ads last quarter, which brought in **25** new customers. Their Google Ads CAC is **800.

Meanwhile, they spent 15,000** on content marketing (salaries, tools) and acquired **30** customers through organic search. Their Content Marketing CAC is **500. Right away, this tells them that content marketing was a more cost-effective channel during that period.

The Power of Cohort Analysis

While channel-level CAC tells you where your best customers are coming from, cohort analysis tells you when you acquired your most valuable users and how that cost changes over time. A cohort is simply a group of customers who all signed up during the same period, like "January 2024 Signups."

This is a vital customer acquisition cost calculation for any business with a longer sales cycle. By tracking CAC by cohort, you can see if your acquisition efficiency is actually improving month over month or quarter over quarter.

For instance, you might find that the CAC for your Q1 cohort was 1,200**, but by Q3, it dropped to **950. That’s a clear signal that your marketing strategies are getting sharper. It also lets you track the lifetime value of specific cohorts against what it cost to acquire them, giving you a much clearer picture of your real ROI.

A blended CAC tells you what you spent. A segmented CAC tells you where you spent it wisely. That distinction is the difference between just reporting metrics and actually using them to build a more profitable business.

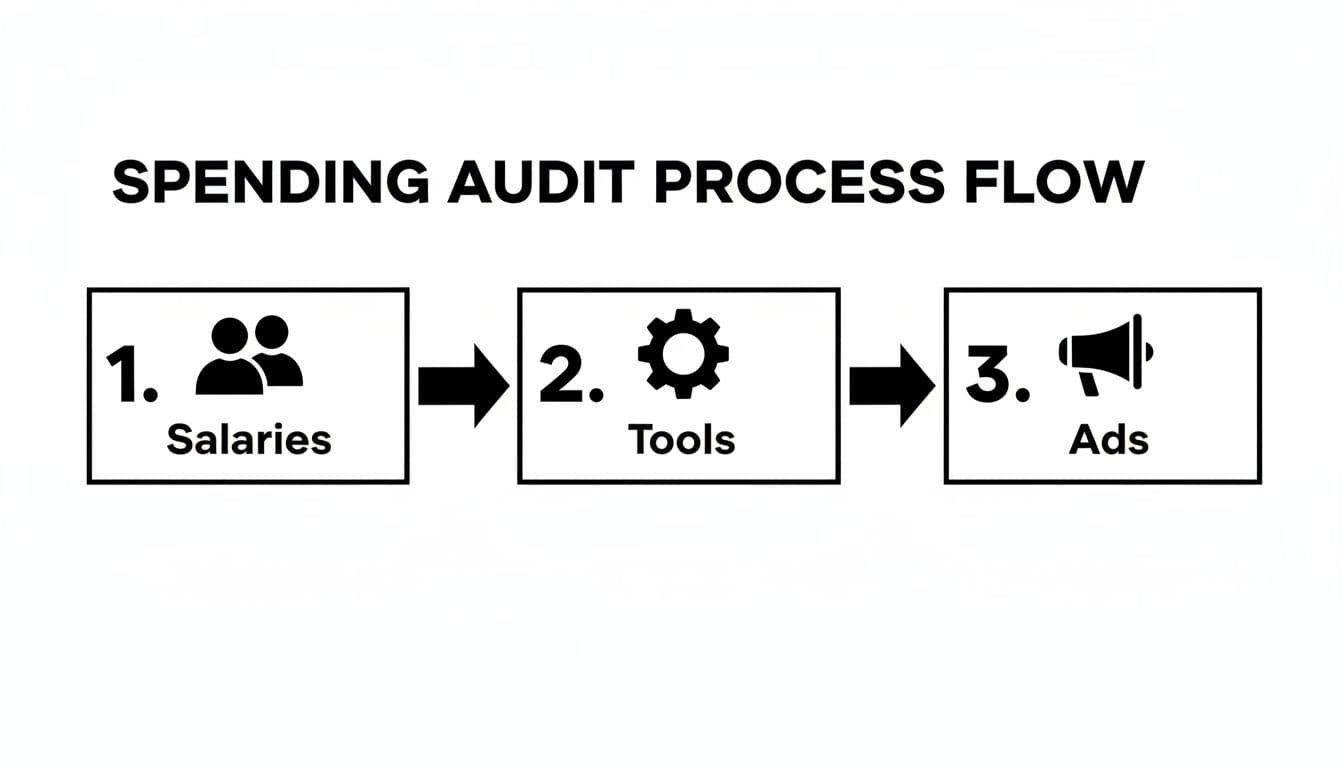

This process flow highlights the key cost centers you need to audit before you can accurately segment your spending.

The visualization breaks down the spending audit into its core components—people, tools, and direct ad spend. Each of these must be accurately allocated to specific channels for your CAC segmentation to mean anything. Without this level of detail, your channel-specific calculations will be based on foggy, incomplete data. Drilling down into these categories is the only way to confidently assign costs and uncover the true performance of each acquisition channel.

Gauging Business Health with LTV and Payback Period

Calculating your Customer Acquisition Cost is a great start, but the number itself doesn't tell you much in isolation. Think of it like knowing your car's speed but having no idea where you're headed. To really see if your acquisition spending is building a healthy, sustainable business, you need to look at CAC alongside two crucial partners: Customer Lifetime Value (LTV) and the CAC Payback Period.

These three metrics tell the complete story. CAC is what you spend. LTV is what you earn. And the Payback Period tells you how long it takes to recoup that initial spend. Without this trio, you're flying blind, trying to navigate your growth strategy with only a fraction of the map.

The LTV to CAC Ratio Unpacked

For my money, the LTV:CAC ratio is the single most important metric for any SaaS or subscription business. It cuts right to the chase and answers the million-dollar question: "For every dollar we spend to get a customer, how many dollars will they eventually give back?"

The math itself is straightforward:

LTV / CAC = LTV:CAC Ratio

A healthy ratio shows that you’re not just acquiring customers, but you're acquiring the right customers—the kind who stick around and generate real long-term value. The industry benchmark for a solid, scalable SaaS business is an LTV:CAC ratio of 3:1 or higher. In other words, for every 1 you put into sales and marketing, you get at least 3 back over that customer's lifetime.

If you need a deeper dive into the different ways to calculate LTV—from simple to predictive—this guide on How to Calculate Customer Lifetime Value is an excellent resource.

A Quick Gut Check: A ratio below 3:1 can be a red flag. It might mean you're overspending, targeting the wrong audience, or have a retention problem. On the flip side, an unusually high ratio, like 8:1, could paradoxically be a bad sign—it often suggests you're underinvesting in growth and leaving money on the table.

Knowing where you stand is the first step toward making smarter decisions about your budget and strategy. You can see how this metric fits into the broader picture by reviewing other key digital marketing performance metrics.

Here's a quick reference for interpreting what your ratio is telling you.

Interpreting Your LTV to CAC Ratio

Finding that 3:1 balance is the goal for most companies looking to scale responsibly.

Calculating Your CAC Payback Period

If LTV:CAC measures profitability, the CAC Payback Period measures efficiency. It answers a different, but equally important, question: "How many months does it take to earn back the money we spent to acquire a customer?"

This is a metric that VCs and CFOs obsess over, and for good reason. It shows how quickly your business can self-fund its own growth.

Here’s the formula:

CAC / (Average Revenue Per Account * Gross Margin %) = Months to Recover CAC

Let’s walk through a real-world example. Imagine your blended CAC is 1,200**. Your average new customer pays **150 per month (your ARPA), and you run a healthy 80% gross margin.

First, you need to find the gross margin-adjusted revenue per month. This is the actual cash you have to work with after accounting for the cost of service.

- 150 (ARPA) * 0.80 (Gross Margin) = **120 per month**

Now, divide your CAC by that monthly figure:

- 1,200 (CAC) / 120 = 10 months

In this scenario, it takes exactly 10 months for this customer to pay for themselves and become profitable.

For most venture-backed SaaS companies, anything under 12 months is considered excellent. It demonstrates a capital-efficient model that can scale without needing endless cash infusions. A longer payback period isn't necessarily a death sentence, but it signals that you'll need to be much more deliberate with your financial planning to fuel growth.

Common Mistakes in Customer Acquisition Cost Calculation

Getting your CAC wrong can lead to some truly disastrous business decisions. It can send your entire growth strategy spiraling in the wrong direction. This isn't just a simple accounting exercise; it's a strategic imperative. The most common errors often look minor on the surface, but they compound over time, painting a dangerously misleading picture of your company's actual health.

Think of it like building a house on a shaky foundation. No matter how impressive the structure looks from the outside, it’s fundamentally unstable. Learning to sidestep these common pitfalls will give you the foresight needed to ensure your numbers are always accurate and, more importantly, actionable.

Forgetting the Fully-Loaded Cost of People

One of the biggest and most frequent mistakes I see is people only using base salaries in their CAC calculation. Your team costs so much more than just their take-home pay. A true, fully-loaded salary has to account for all the other expenses that come with employing someone.

To get a real number, you have to include:

- Benefits: This is everything from health insurance contributions to retirement plan matching. These costs can easily tack on an extra 20-30% to a base salary.

- Commissions and Bonuses: Any performance-based pay for your sales team is a direct cost of acquiring a customer and must be included.

- Payroll Taxes: Employer-side taxes are a significant expense that often gets completely overlooked.

If you don't include these "hidden" costs, your CAC will look deceptively low. You might end up thinking an unprofitable channel is a winner, and that’s a small oversight with major consequences for your budget.

Blending Acquisition and Retention Costs

Another classic error is lumping all of your marketing and sales spend into one giant bucket. Your budget really serves two distinct functions: winning new customers and keeping the ones you already have. Things like a newsletter sent to current clients or the salary of a customer success manager are retention costs, not acquisition costs.

Mixing these expenses together will artificially inflate your CAC. For example, if your content team spends 30% of its time creating case studies and help docs for existing users, then 30% of their fully-loaded cost should be left out of the CAC formula.

Your CAC should only reflect the money you spend to win new business. Diluting it with retention-focused expenses masks the true efficiency of your acquisition engine and can trick you into cutting a perfectly healthy marketing channel.

Using the Wrong Timeframes

Timing is everything, especially for B2B and SaaS businesses that often have long sales cycles. A huge mistake is to calculate CAC for a single month by taking that month’s expenses and dividing by the customers who signed up in that same month. This is a recipe for bad data.

A customer who signs up in March was probably nurtured by marketing efforts from back in January and February. The costs to acquire them were actually spread over several months.

The solution is to account for the time lag between your spending and when the customer actually converts. If your company has a 60-day average sales cycle, a much more accurate approach is to divide March's new customers by the sales and marketing spend from January. This correctly aligns the investment with its return, giving you a far clearer picture of your acquisition efficiency. This kind of nuance is what separates basic reporting from real strategic analysis.

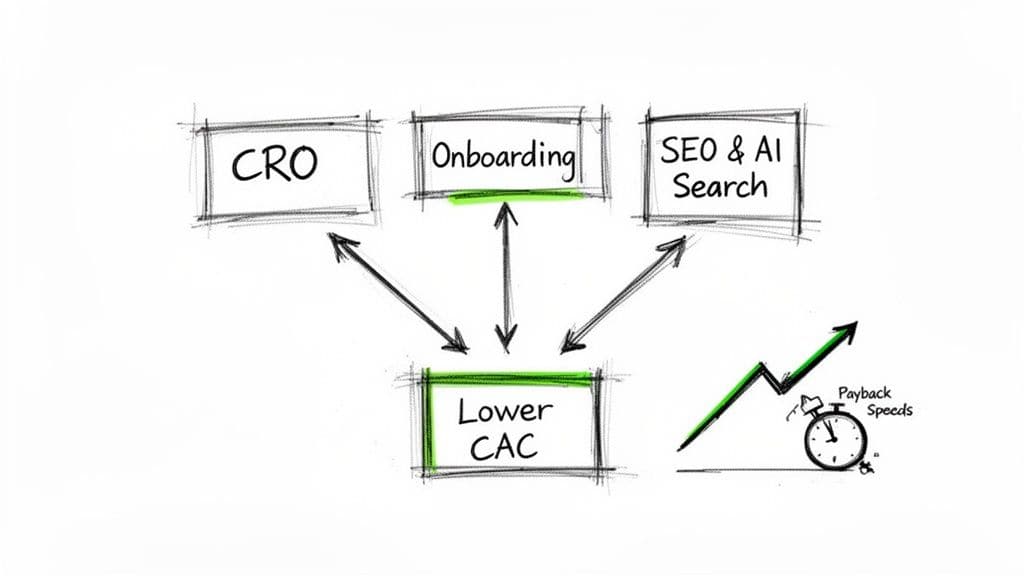

Actionable Strategies to Lower Your CAC

Knowing your CAC is one thing. Actively driving it down is how you build a truly resilient business. This isn’t about recklessly slashing budgets; it’s about making smarter, more efficient investments to build a sustainable acquisition machine. The real aim is to attract high-value customers without constantly pouring money into a leaky bucket.

Think of it as a holistic effort. Every stage of the customer journey, from that very first touchpoint to long-term loyalty, is an opportunity for optimization. By focusing on a few high-impact tactics, you can transform your acquisition spend from a necessary evil into a powerful growth driver.

Optimize Your Conversion Funnel

The quickest path to a lower CAC is often found by getting more out of the traffic you already have. This is where conversion rate optimization (CRO) is your best friend. Even tiny lifts in your conversion rates can dramatically improve your acquisition efficiency.

Start with the low-hanging fruit: your key landing pages, demo request forms, and signup flows. Use tools for heatmaps and A/B testing to spot where users are dropping off. Are they confused by the headline? Is the call-to-action buried? Testing different copy, layouts, and CTAs can give you huge wins. A smoother user experience means more conversions from the same ad spend, which directly slashes your cost per customer.

Don’t forget about what happens after the conversion. A clunky, confusing onboarding process is a recipe for quick churn, erasing all the hard work you did to acquire that customer in the first place. A solid onboarding experience protects your investment and sets the stage for a long-term relationship.

A 1% improvement in conversion rate doesn't just mean 1% more customers. It means your entire marketing spend just became 1% more efficient, lowering your CAC across the board without spending an extra dime.

Build a Powerful Organic Engine

Paid channels give you predictability and speed, but relying on them exclusively is a dangerous game. As costs rise, your CAC will inevitably creep up. The sustainable, long-term play is building a powerful organic acquisition engine through SEO and content marketing. You shift from "renting" your audience's attention to "owning" it.

This is especially true in the B2B world. While e-commerce CAC can be manageable, B2B SaaS CAC can easily climb to $702. The smartest companies know that retention is the real growth lever. It costs 5-25x less to keep an existing customer than to acquire a new one, and for many top B2B firms, existing customers drive over 65% of their revenue. For comparison, you can explore some typical e-commerce CAC benchmarks on LoyaltyLion.

This is precisely where boosting your visibility in AI-driven search gives you a serious competitive edge. Tools like Attensira are designed to help you pinpoint content gaps and create assets that align with how modern search engines—like Perplexity and Google’s AI Overviews—surface information.

By creating content that directly answers high-intent questions, you pull in qualified leads organically. This strategy is a direct counterpunch to rising ad costs and helps solve some of the most common B2B marketing challenges by building a more resilient and profitable growth model.

Common Questions About Calculating CAC

Even when you've got the basic formula down, real-world scenarios can throw a wrench in the works. Let's tackle some of the most common questions that pop up when you start applying this stuff to your own business.

How Do You Handle CAC For a Freemium Model?

This one trips people up all the time. With a freemium model, you have to be disciplined about separating the cost of acquiring a free user from the cost of acquiring a paying customer.

Your main CAC calculation should only include the sales and marketing spend that's explicitly designed to convert free users to paid accounts. Think of things like an email campaign to your free user base highlighting premium features—that cost goes into your CAC. A broad, top-of-funnel ad campaign just to get more free sign-ups? That's a separate cost and shouldn't muddy your paying customer CAC.

What Is An Ideal Payback Period?

There's no single magic number here; the "right" answer really depends on how your company is funded. The general benchmark for SaaS is to get your money back in 12 months or less.

But let's break that down:

- VC-Backed Companies: If you have venture capital, you can usually stomach a longer payback period, maybe in the 12-18 month range. The goal is aggressive growth, and you have the cash reserves to fuel it.

- Bootstrapped Companies: When you're running on your own cash, capital efficiency is everything. You should aim for a much shorter payback, ideally under 6 months. This lets you reinvest your profits back into the business much faster.

A shorter payback period is your financial shock absorber. It means you’re not as dependent on outside investment and can grow sustainably, which is why it's a metric every bootstrapped founder should be watching like a hawk.

How Often Should You Calculate CAC?

You need to be calculating and reviewing your CAC at least monthly. This gives you enough data to see meaningful trends without getting bogged down by tiny day-to-day blips.

That said, if you're running a specific, high-stakes campaign—like a big product launch or a major ad push—it’s smart to keep a closer eye on your channel-level CAC. Checking it weekly in these cases lets you spot a failing channel and shift your budget before you've burned through too much cash.

Ready to slash your acquisition costs by improving your visibility in AI-driven search? Attensira provides the insights and tools to get your brand noticed. Discover how it works.